Transforming the Way Investment Managers, Originate, Transact and Monitor Investments

Alternative Investment Management, a Sector Ready for Digital Transformation

Our involvement in the alternative investment sector over the last decade has allowed us to develop a detailed understanding of the end-to-end investment management process.

Throughout this time we have seen many a change, however, for the most part of it, the sector has always turned up late to the party when it comes to innovation and digital transformation – ultimately restricting the entire process and reducing the overall efficiency of investments.

Improving Efficiencies for Alternative Investment Managers

Many alternative investment managers currently use a combination of manual processes to manage their investments end-to-end. Whether it be multiple spreadsheets or the countless third-party software, there’s no doubt these do work over time, but it’s simply not practical and certainly no way to work in this day and age.

Time is everything, and by utilising so many manual resources, it’s not only inefficient and exhausting – it prevents you from focusing on what’s most important, your clients.

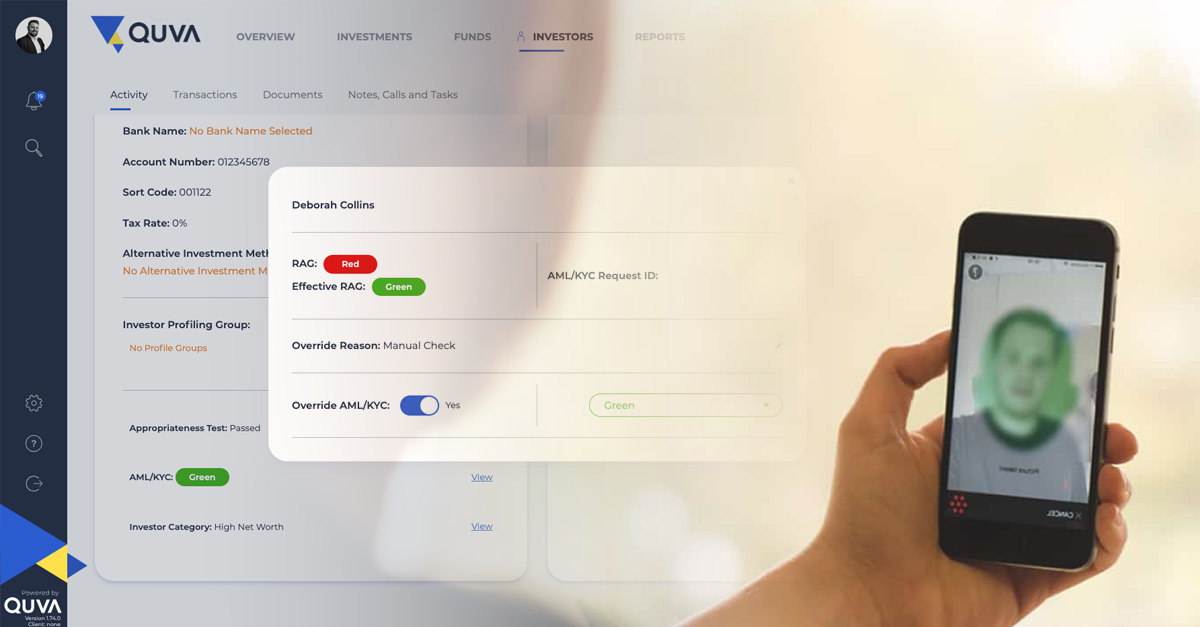

With Quva, Alternative Investment Managers – including Angel Networks, Venture Capital Fund Managers and Private Equity Fund Managers – are provided with a highly customisable and highly configurable end-to-end solution. Our white-label investment platform can be scaled, adjusted and defined by individual requirements.

It is clear alternative investment drives the UK economy by powering high-growth businesses and the managers behind such investment need to be provided with the opportunity to originate better quality deals, provide capital faster and make better decisions to support portfolio companies. They need to create value in the most effective way – what they don’t need is inefficient systems that hinder value creation.

Developed by Investment Professionals for Investment Professionals

Quva combines a clear understanding of the investment origination, transaction and monitoring process with our development team’s vast experience of creating bespoke software solutions. The result is a business-critical alternative investment software solution that enables an unparalleled and transparent view of the entire investment process from deal origination to realisation and exit.