Maximise Investor Engagement Through Technology

It's widely acknowledged that a significant portion of investments originate from a select few within your network. While this dynamic isn't inherently negative, tapping into the untapped potential of the remaining 80% can significantly enhance the profitability of your network.

While maintaining relationships with the established 20% of investors is crucial, redirecting attention towards the broader 80% can yield greater success. However, achieving this isn't always straightforward, or is it?

The primary obstacles often revolve around time and resources, hindering the realisation of the 80%'s potential. Nevertheless, leveraging software and appropriate digital tools can streamline processes such as compliance, documentation, and tailored promotion, enabling a seamless investment process. This, in turn, frees up valuable time for the day-to-day running of your firm, but also enables scalability within your organisation.

Let’s Start With Compliance

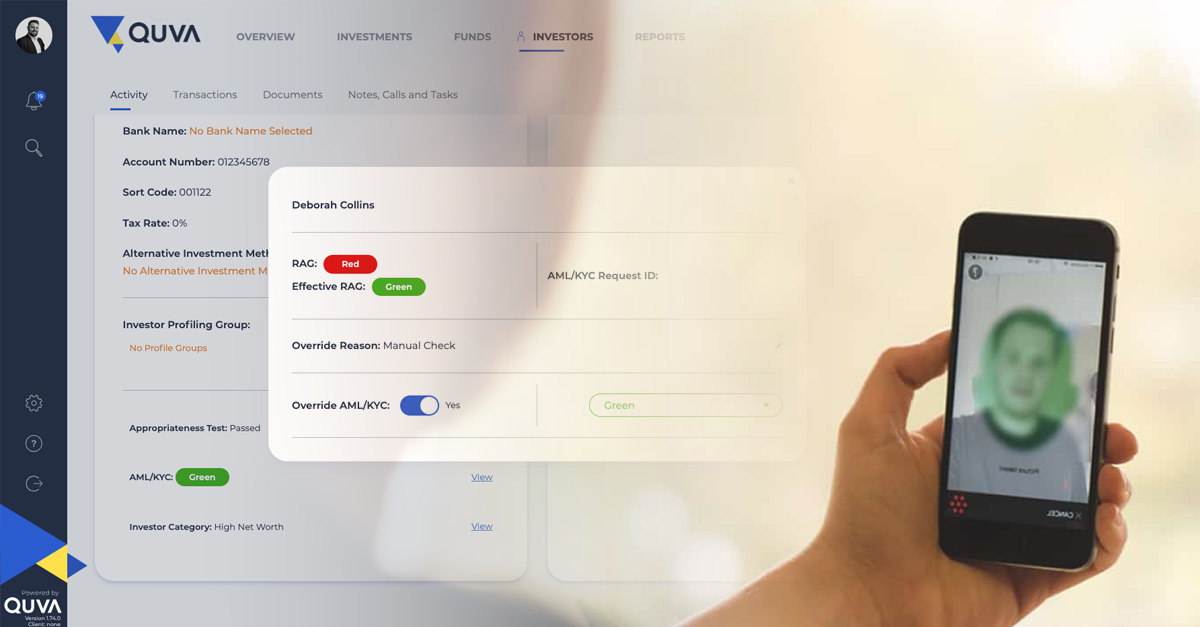

Ensuring compliance is essential for any regulated investment firm, yet it often entails laborious and time-consuming tasks. By leveraging third-party digital tools for functions such as AML/KYC and Investor Categorisation, firms can enhance efficiency and reclaim valuable time. But what if you could access all these tools in one unified platform alongside your deal flow, opportunities, and investor records?

Enter Quva, a comprehensive digital SaaS (Software as a Solution) solution designed to streamline compliance efforts while catering precisely to the needs of your firm and investor network. With Quva, you can seamlessly manage investor categorisation, conduct investor appropriateness tests, facilitate NDA agreements with e-signatures, and perform real-time AML/KYC checks with ongoing alerts for PEP and Sanctions.

By consolidating these capabilities into a single solution, Quva not only saves time and increases efficiency for your back office but also delivers a seamless and frictionless experience for your investors, thereby enhancing overall engagement.

Distribution Made Easy

Whether it's during onboarding or throughout the investment process, Quva meticulously captures and securely stores investor data, aligning it with their respective records. This not only ensures compliance adherence but also optimises the distribution of investment opportunities.

By leveraging this comprehensive dataset in conjunction with Quva's seamless deal distribution, you can precisely target individuals with tailored opportunities based on their unique interests and profile criteria. For instance, deals specifically relevant to "High Net Worth Individuals" can be efficiently identified and distributed in seconds.

Moreover, employing custom tags allows for further personalisation, where investors can be tagged with specific interests such as preferences for ‘Real Estate’ opportunities in ‘New York’. This strategic approach fosters a seamless and engaging experience for both you and your investors.

Communication is Key

Effective communication is paramount in all endeavours, particularly in maintaining engagement within your investor network.

While traditional communication methods such as email, telephone, and face-to-face interactions remain valuable, they often demand immediate time and attention.

Quva offers a secure communication channel through both client and admin portals, facilitated by an encrypted chat tool. This feature instills confidence in investors, providing them with a platform to inquire about specific opportunities, thus optimising engagement.

Furthermore, real-time email and in-app notifications empower your back office to respond promptly, either instantly or at their convenience, with the assurance that conversations are securely archived. This not only enhances engagement but also contributes to compliance efforts by ensuring communication traceability and security.

Make it Personal

Personalisation undoubtedly yields superior results across various facets of our day-to-day lives, that also includes investment opportunities. Tailoring these opportunities to match the precise needs and interests of your investors fosters heightened engagement, thereby driving better outcomes for your organisation.

With Quva, you not only have the capability to selectively target specific investors with tailored opportunities, but you can also enhance their appeal through customised imagery and content, maximising their appeal.

Quva facilitates the upload of custom imagery, tailored text, social links, and even embedded videos and team bios.

Additionally, it provides a secure repository for essential documents like investment memorandums, while enabling direct communication between investors and your team through the platform. This integration fosters trust, transparency, and ultimately, elevated engagement levels.

Seamless Investing

Investors utilising the Quva platform will discover a seamless and efficient process when committing to investments. With all the essential information, documents, and compliance conveniently presented within the platform, investing requires just a few clicks. You can even facilitate the automation of e-signature should you require it as part of the investment process.

The days of scheduling meetings with investors, coordinating calendars, and the back and forth with extensive paperwork are gone. Empowering investors to make swift decisions not only enhances engagement but also encourages increased activity overall.

Conclusion

In conclusion, maximising investor engagement through software solutions like Quva is not only pivotal in today's investment landscape but also essential for sustaining long-term success. By recognising the untapped potential within the broader investor network and leveraging innovative tools, firms can streamline compliance efforts, optimise distribution processes, and foster personalised interactions.

Quva's white-label solution offers a seamless experience for both firms and investors, enhancing efficiency, transparency, and engagement. Through effective communication channels and tailored opportunities, firms can cultivate stronger relationships and drive better outcomes.

Ultimately, embracing software like Quva not only revolutionises the investment process but also paves the way for scalable growth and enduring success in the ever-evolving financial landscape.

To see how Quva can help you, simply request a demo today and one of our sales professionals will be delighted to provide you with a personalised tour of the platform.