Family Office Software

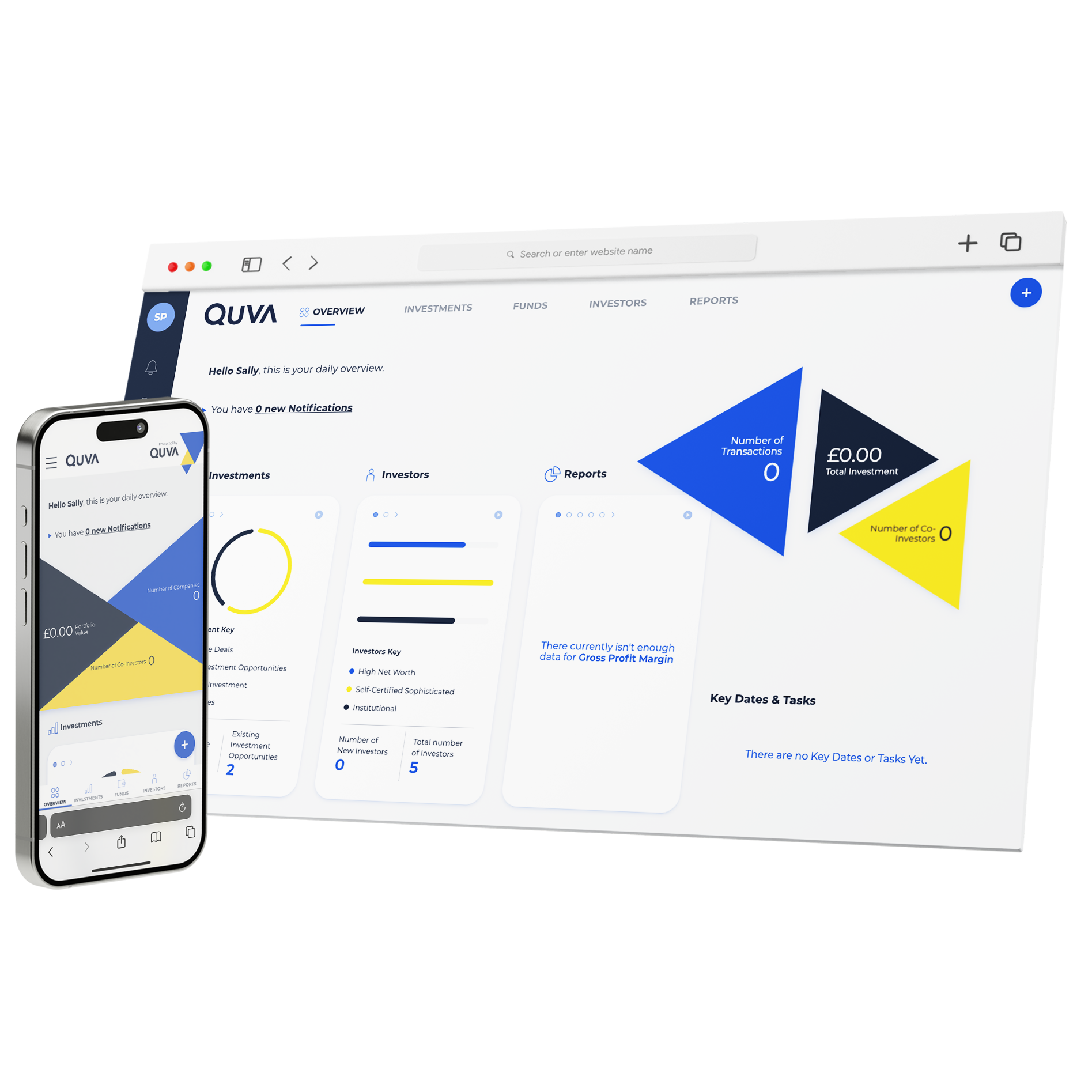

Next-Level Investment Management Software for Family Offices

Highly customisable and configurable software solutions built for the Family Office Sector.

Digital Transformation for Family Offices

With increasing portfolio allocation to alternatives, family offices have a growing need to streamline their operations. Quva offers the ultimate family office software solution suite to cover your entire investment cycle: from due diligence and portfolio planning to portfolio tracking and advanced performance and risk analysis.

Built for the Family Office Sector

Made for alternative investment professionals

We create state-of-the-art alternative investment software that enables the world's leading finance professionals streamline their end-to-end alternative investment propositions on any device, from anywhere and at any time.

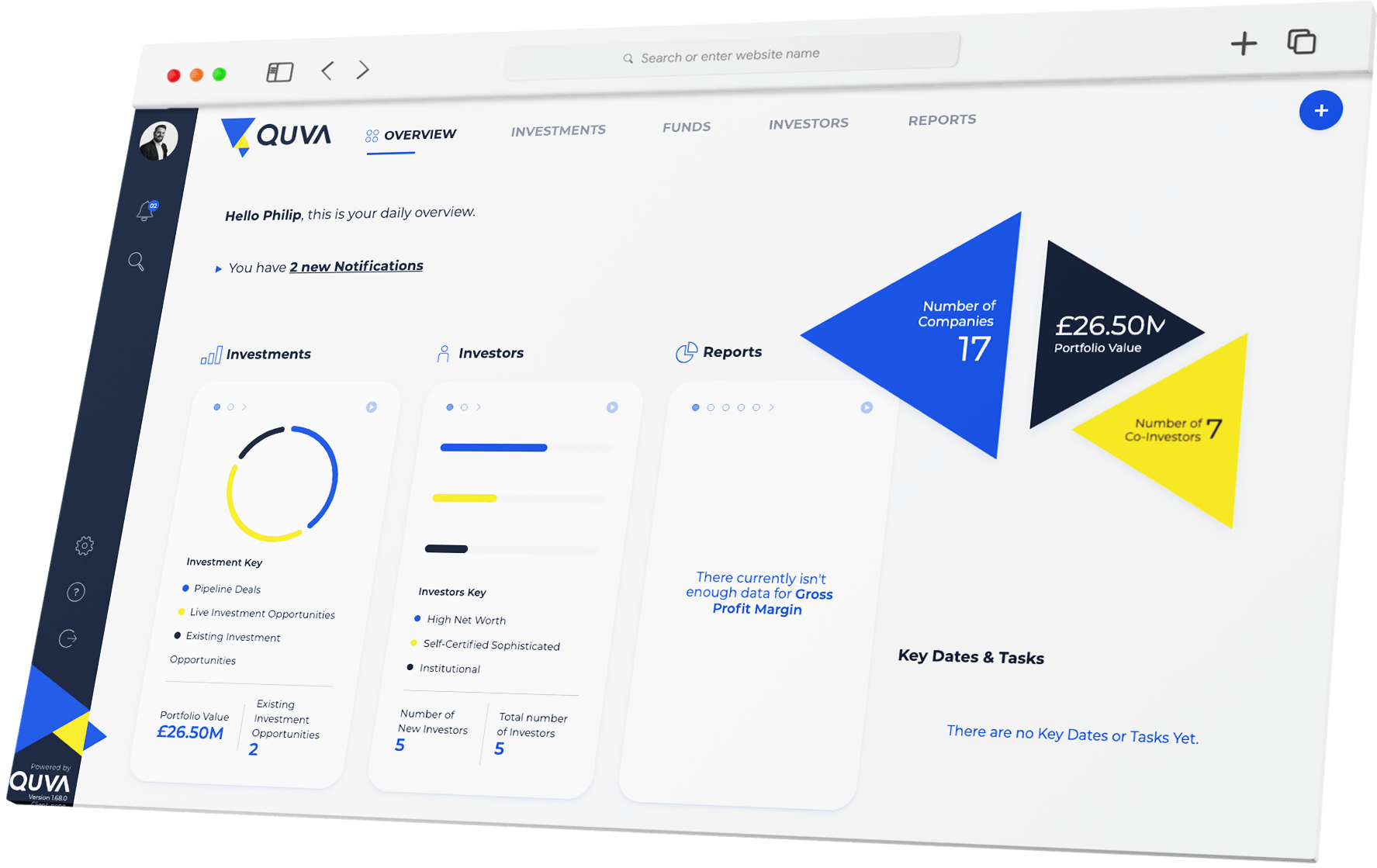

Customisable, Easy-To-Use Dashboards

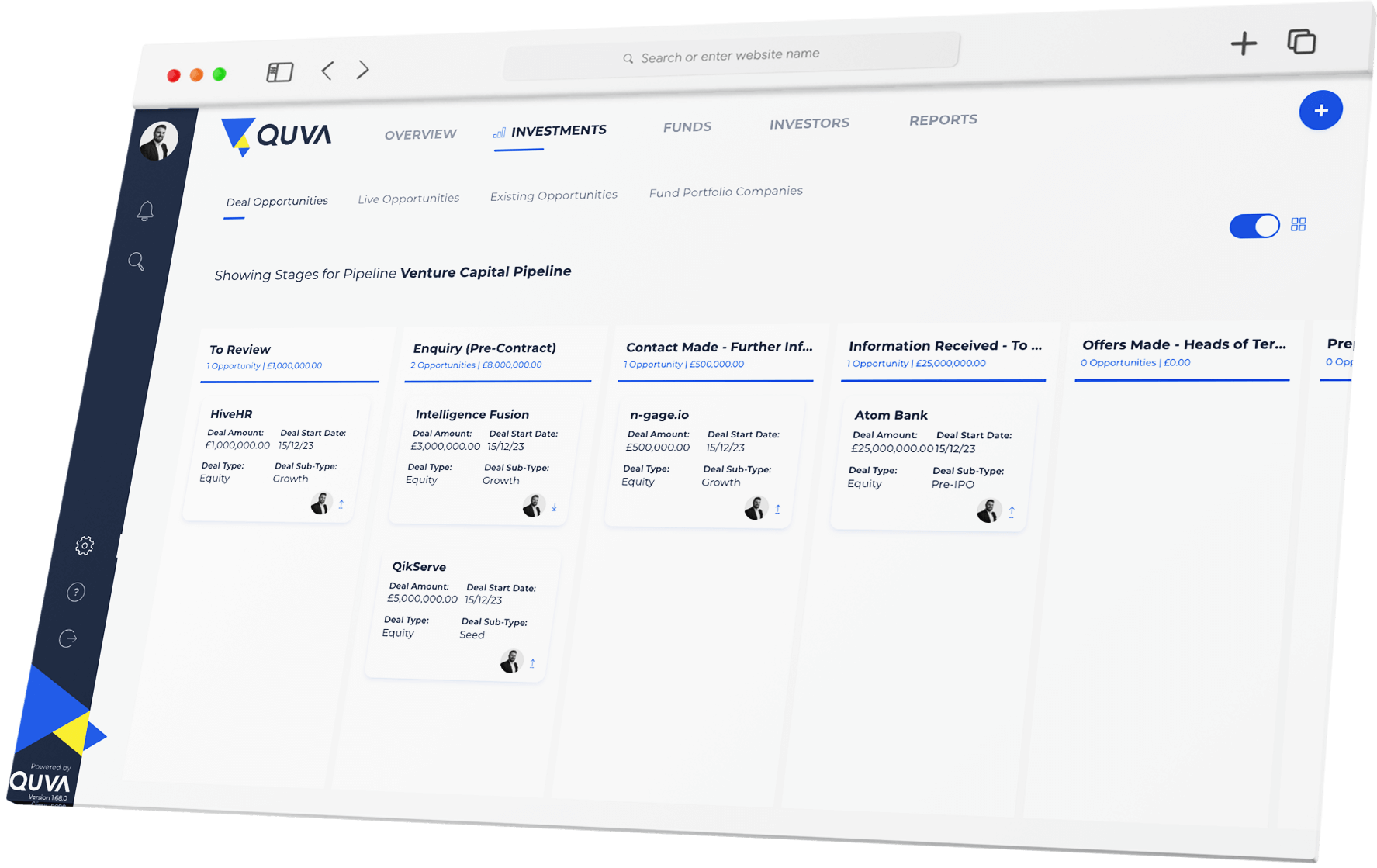

Custom Pipelines

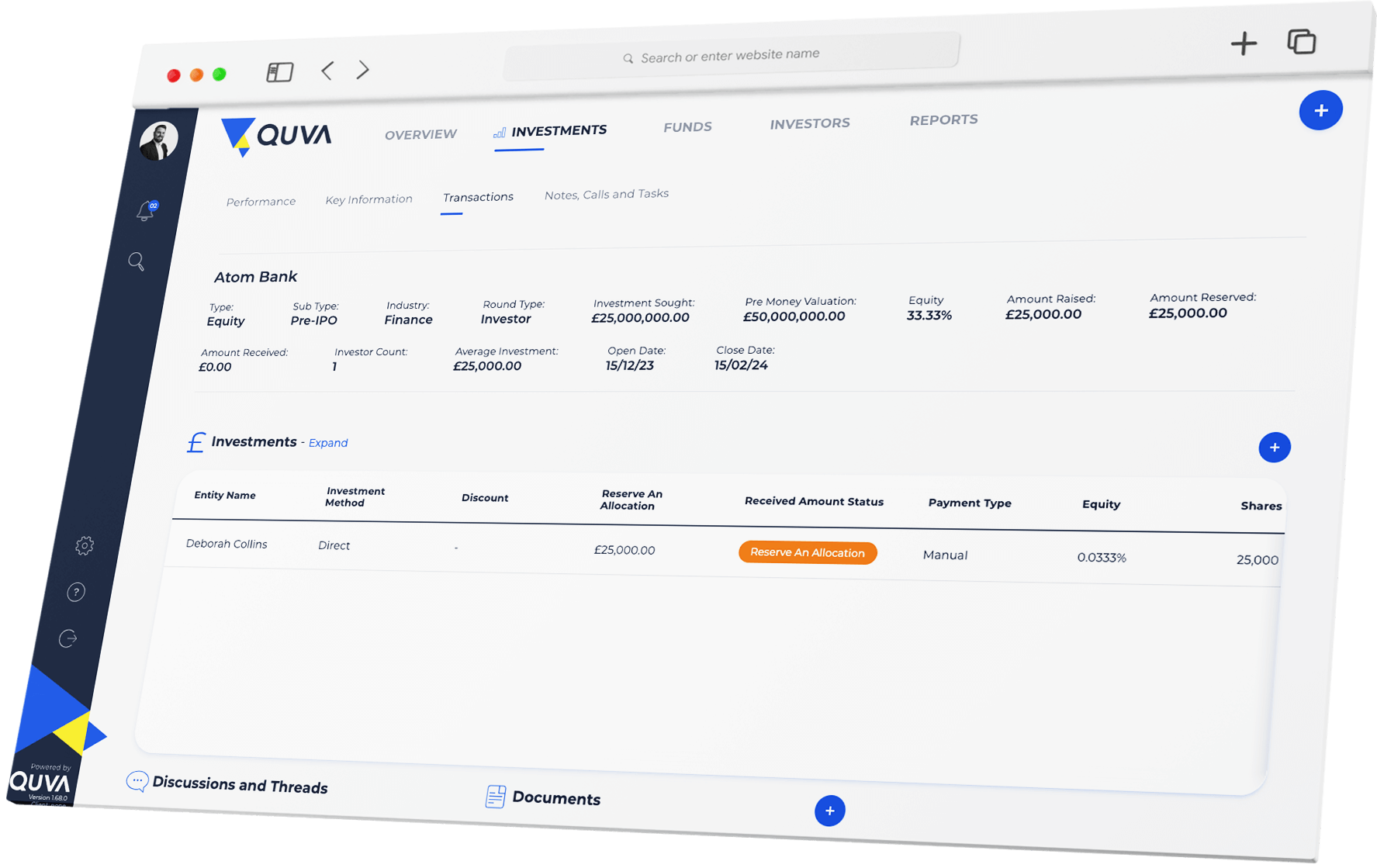

Opportunity Transactions

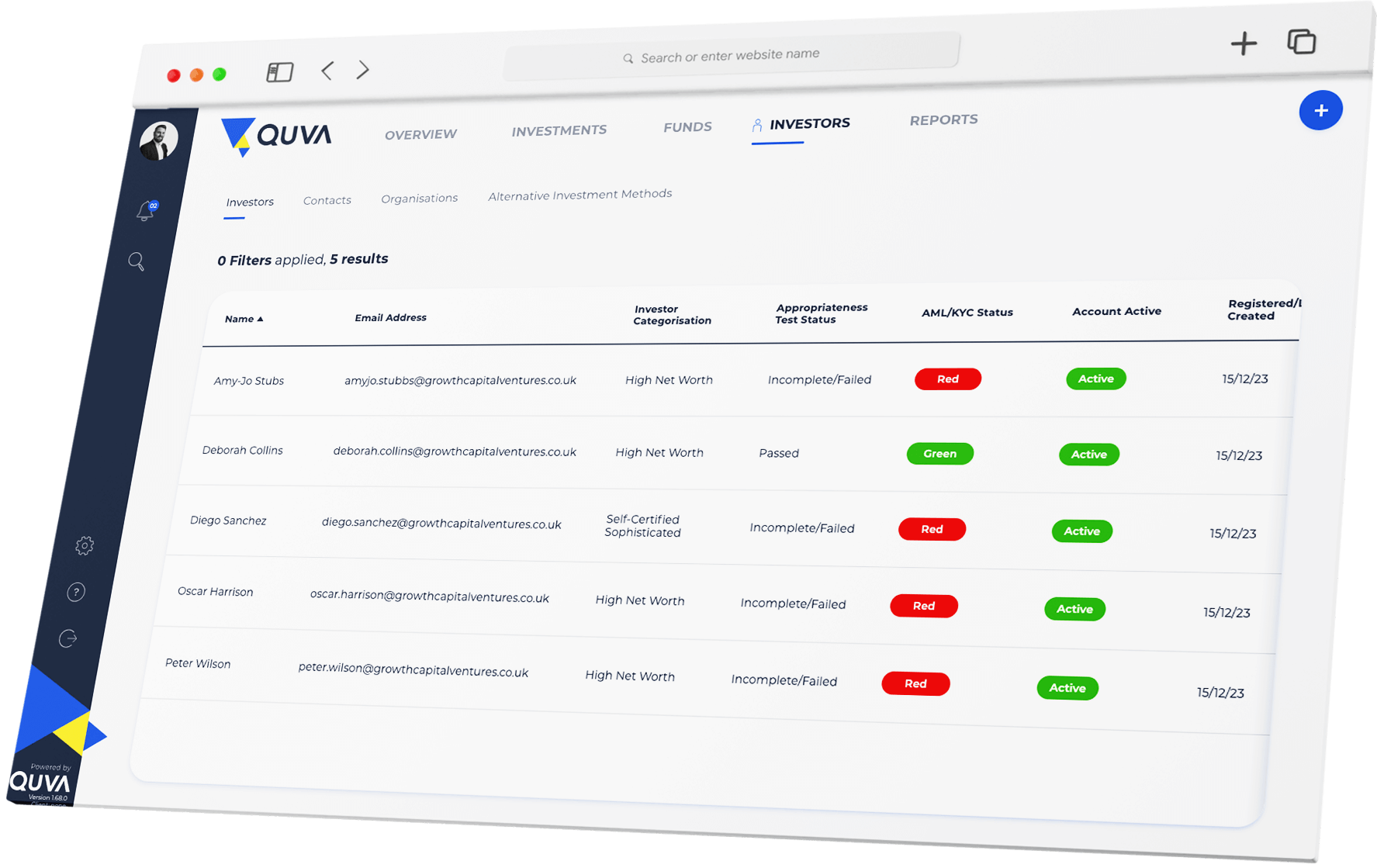

Client CRM

KPI Dashboard

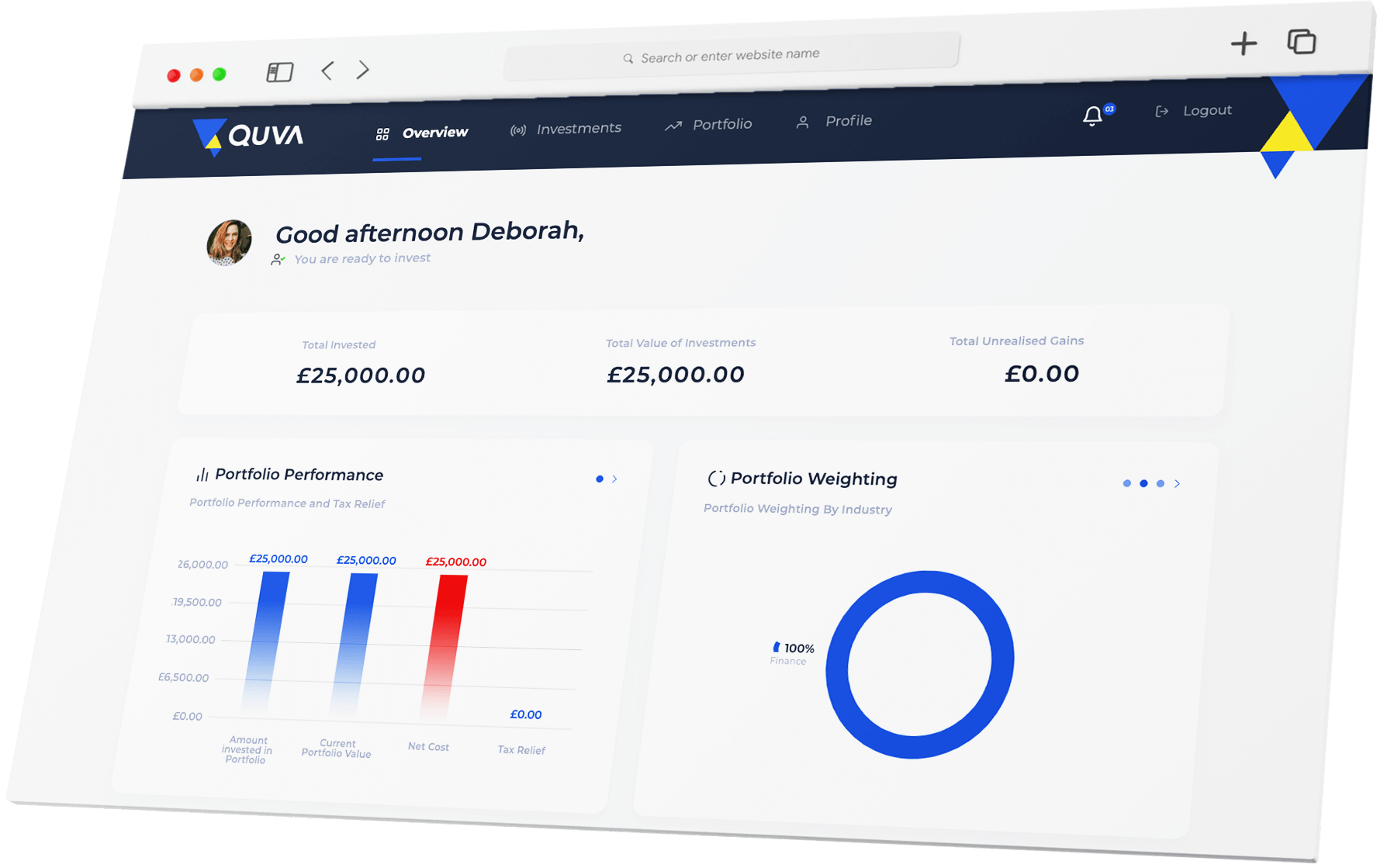

Investor Portal

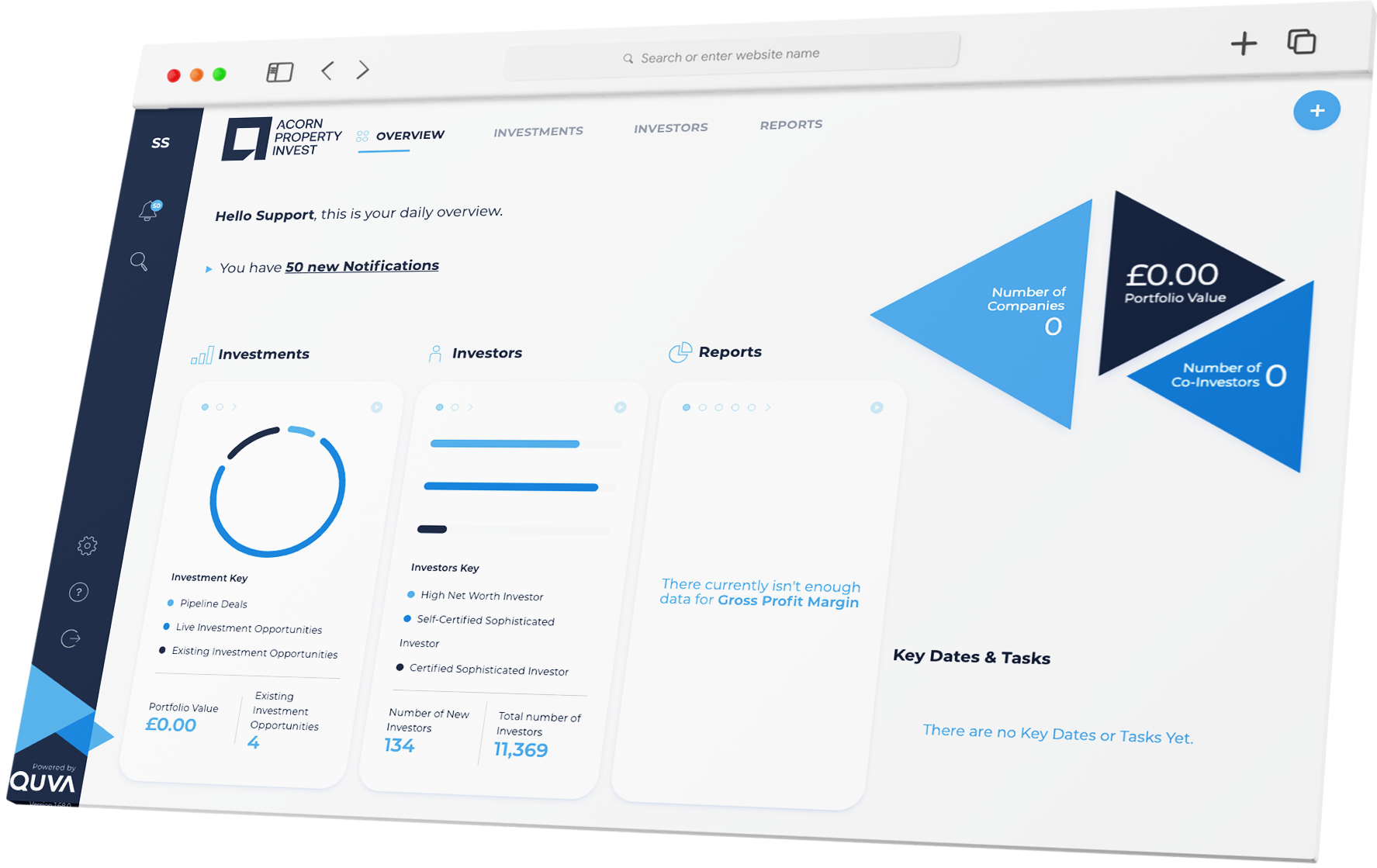

White-label Solution

Quva's white-label solution allows you to edit the look and feel of your platform, enabling you to showcase your company brand.

Updated within the settings area in seconds, you can update things like the colour scheme, upload logos as well change the terminology to suit your exact needs.

Made by Investment Professionals for Investment Professionals

The team transforming alternative investments

Key Features

Quva offers a robust suite of solutions that enable Alternative Investment professionals across the globe to manage entire investment opportunities from start to finish.

Client Onboarding

Client Portal

Compliance

Back Office

Documents

Reporting

CRM

Transactions

Settings & Customisation

Discuss your needs and see Quva in action with a live, in-depth and personalised demo.

Frequently Asked Questions

-

Quva is a highly customisable and configurable Private Markets Platform designed for Private Markets Investment Professionals. It enhances the management and oversight of investments in private equity, real estate, infrastructure, and other private markets.

-

Quva is designed for Private Markets Investment Professionals, including fund managers, institutional investors, family offices, and advisors who manage private market investments and seek an efficient, integrated solution.

-

Quva stands out with its unparalleled customisation and configurability, allowing users to tailor the platform to their specific investment strategies and workflows. It integrates seamlessly with existing tools and provides a comprehensive feature set.

-

With all Quva solutions being fully customisable and bespoke to the client, an exact cost will be determined based on your requirements. Simply get in touch with us today and we’ll be happy to give you a custom quote.

-

Quva is highly customisable, allowing users to configure modules, workflows, and reports to fit their unique needs. This flexibility ensures that Quva can adapt to the specific requirements of different private market investment strategies.

-

As Quva is fully customisable and bespoke to each client, it usually takes a little onboarding and custom development to get you up and running. The exact amount of time is purely down to the requirements of your own needs.

-

Yes, Quva is designed for seamless integration with various third-party software, including CRM systems, accounting tools, and data providers, ensuring a cohesive and streamlined workflow.

-

Quva provides comprehensive support, including onboarding assistance, training sessions, and ongoing technical support. Our dedicated team is available to help users maximise the platform’s potential and address any issues that arise.

-

Implementing Quva is designed to be smooth and efficient. Our structured onboarding process, guided by our expert team, ensures a seamless transition with minimal disruption to your operations.

Quva News & Insights

Who we work with

Whether you’re looking to streamline how you manage your investments, or simply have a burning question, get in touch today and see how Quva can help take you and your business to the next-level.

Simply fill out the form and of our digital transformation experts will be in touch.