Investment Compliance Solutions

Digitally transform your compliance efforts and processes with Quva's intuitive and customisable platform

Compliance Made Easy

Quva's Compliance functionality ensures adherence to local and international regulations with customisable alignment. It conducts rigorous AML/KYC checks and monitors PEP and Sanctions lists in real-time. Administrators receive instant alerts regarding discrepancies, empowering organisations to manage regulatory complexities confidently, mitigate risks effectively, and maintain compliance seamlessly.

Control the Risk

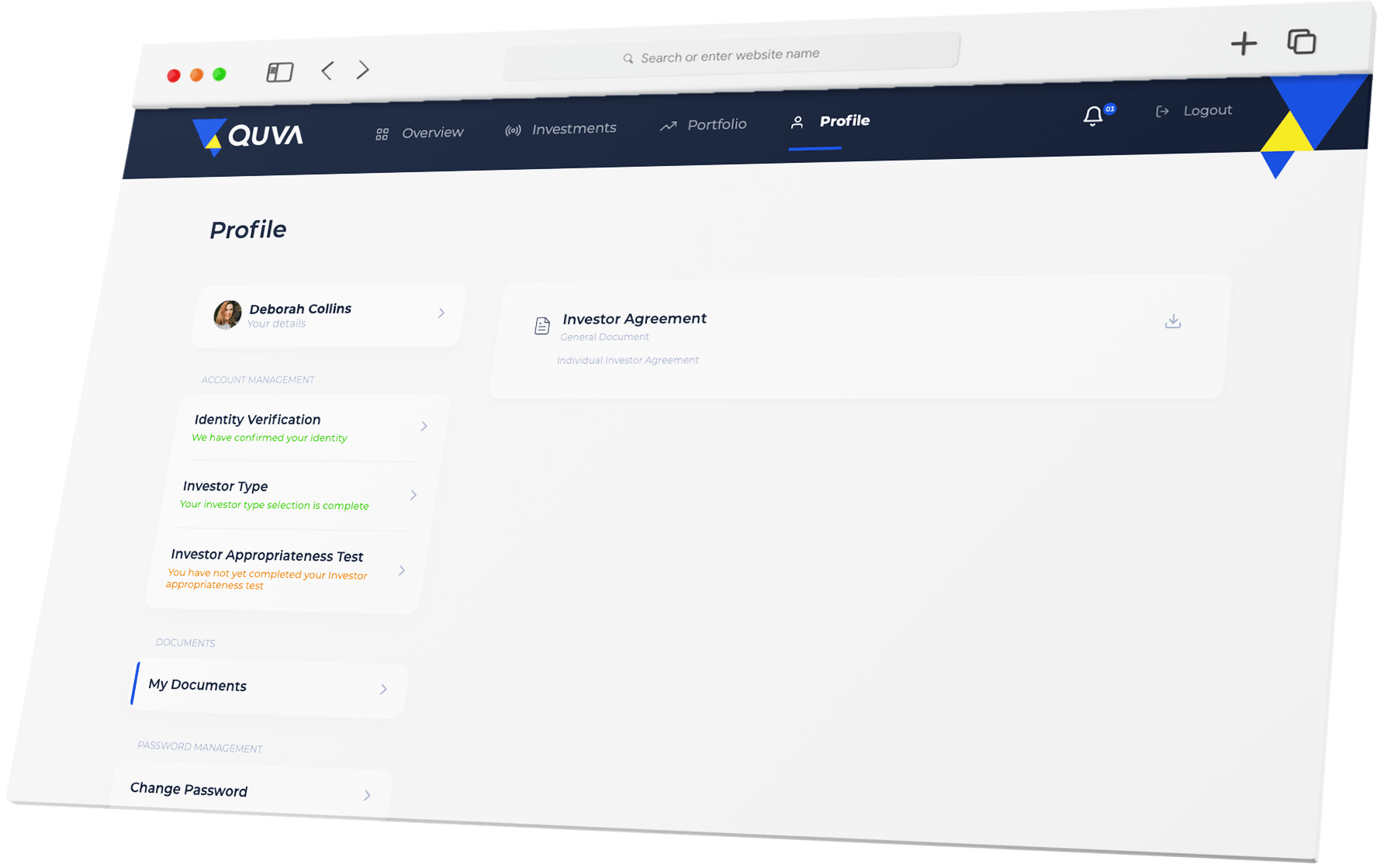

Quva's client portal allows investors to securely login to their client portal at anytime, anywhere. Quva's client portal increases engagement, efficiency and can help overall revenues by taking the administrative burden away. Just some of the features Quva's client portal has to offer:

- Create custom onboarding registration

- Run real-time AML & KYC checks

- Receive ongoing PEP and Sanction checks

- Content manage and create investor categorisation

- Create investor appropriateness tests

- Display regulatory messaging

- Enable NDA functionality

- Automatically generate compliance documents

- Communicate with investors throughout onboarding

Compliance Features

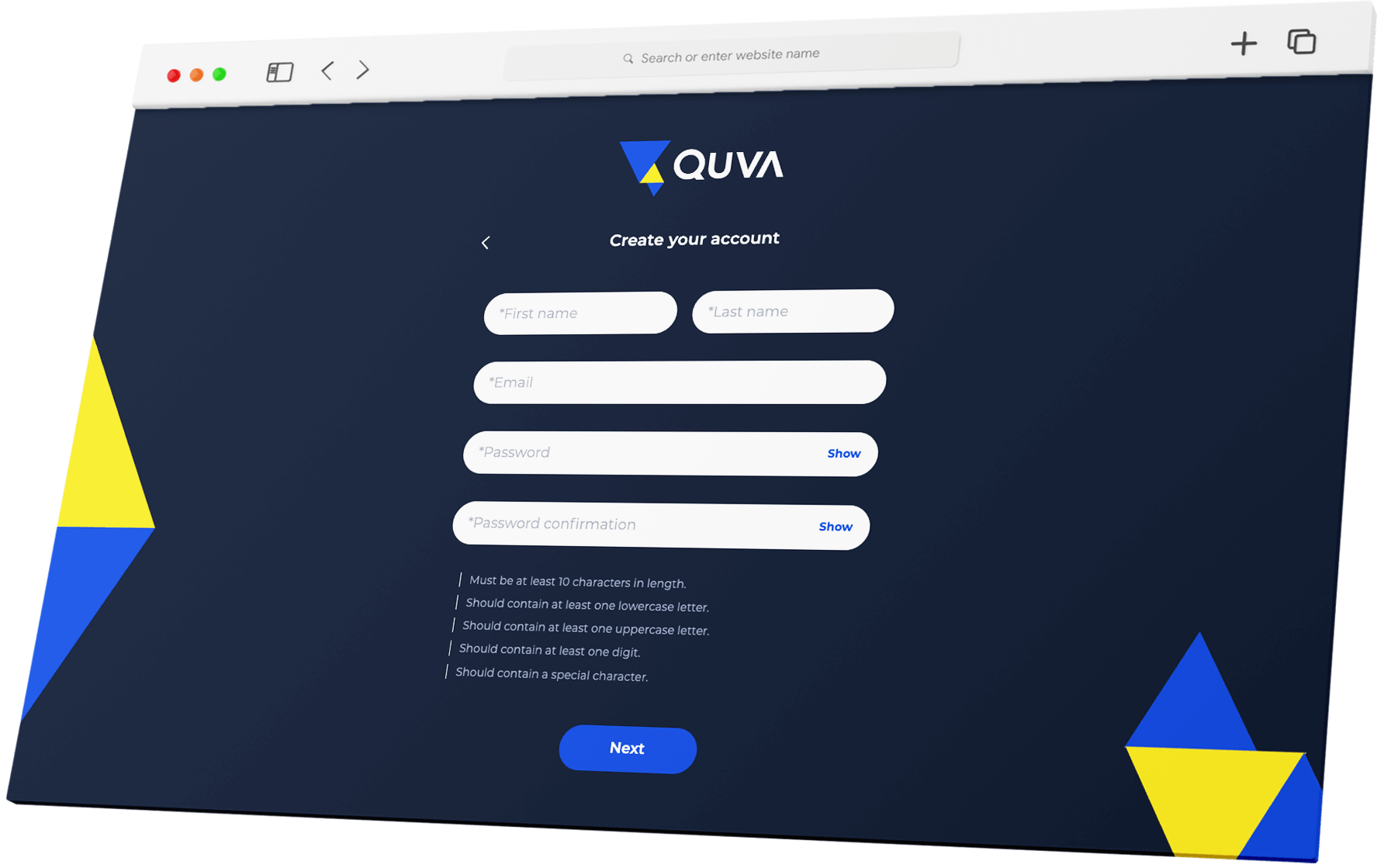

Bespoke Registration

Tailored precisely to individual requirements, Quva digitally transforms and streamlines client onboarding, Through innovative digital tools and personalised processes, Quva ensures a seamless transition, minimising administrative burden and enhancing client satisfaction.

Experience efficiency and precision like never before with Quva's bespoke onboarding registration.

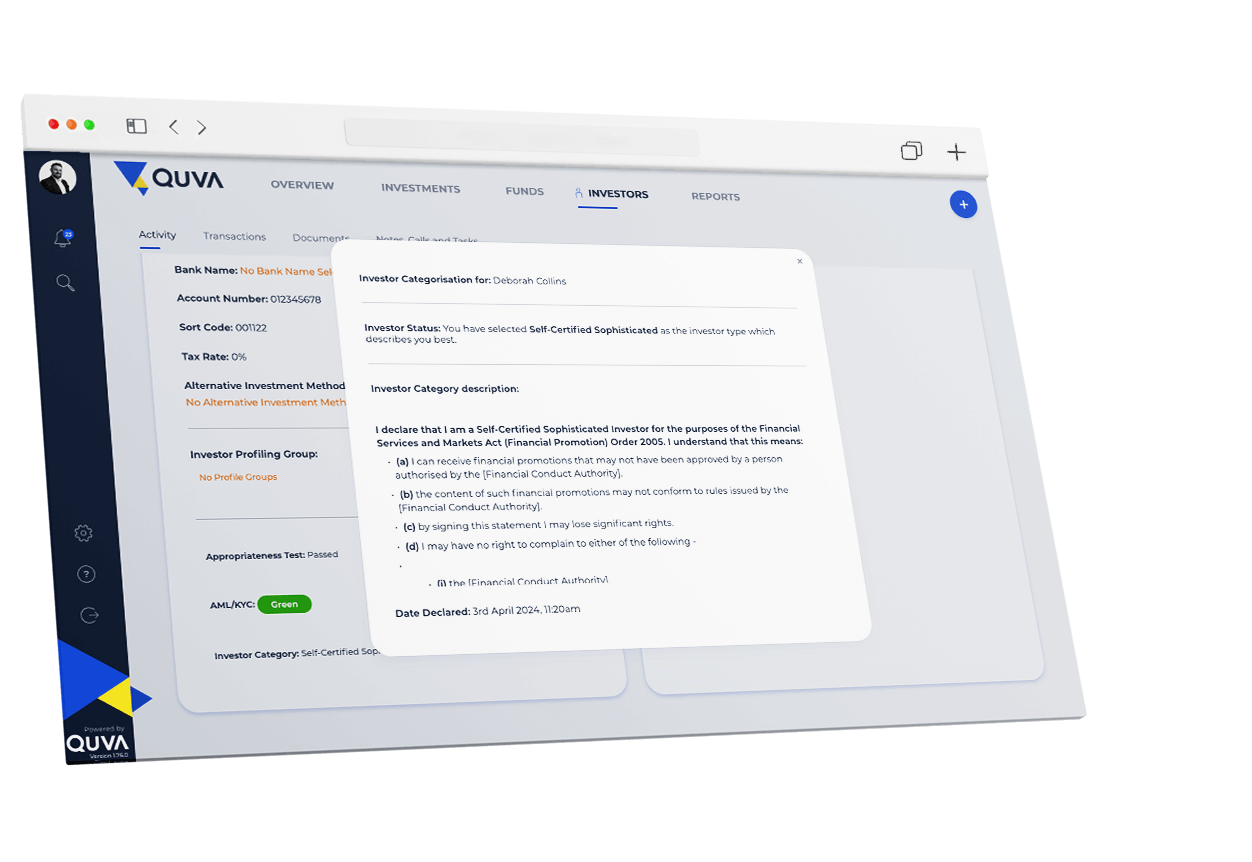

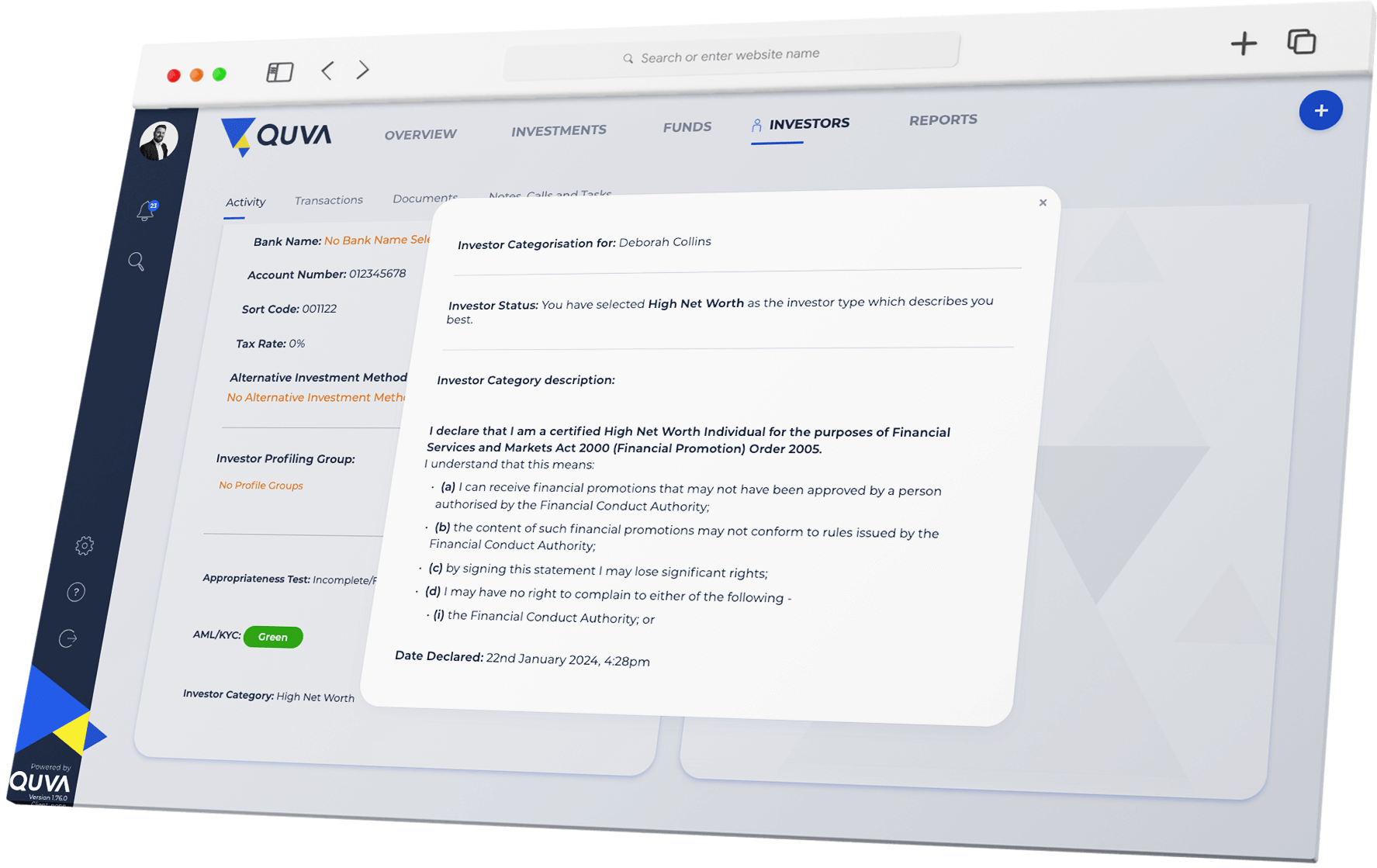

Investor Categorisation

Quva provides bespoke and meticulous investor categorisation, which is also documented to bolster compliance endeavours. By efficiently categorising investors based on your or regulatory criteria, Quva ensures adherence to compliance standards, mitigating risks and enhancing regulatory confidence.

Experience peace of mind knowing that Quva's robust categorisation process aligns seamlessly with your compliance requirements.

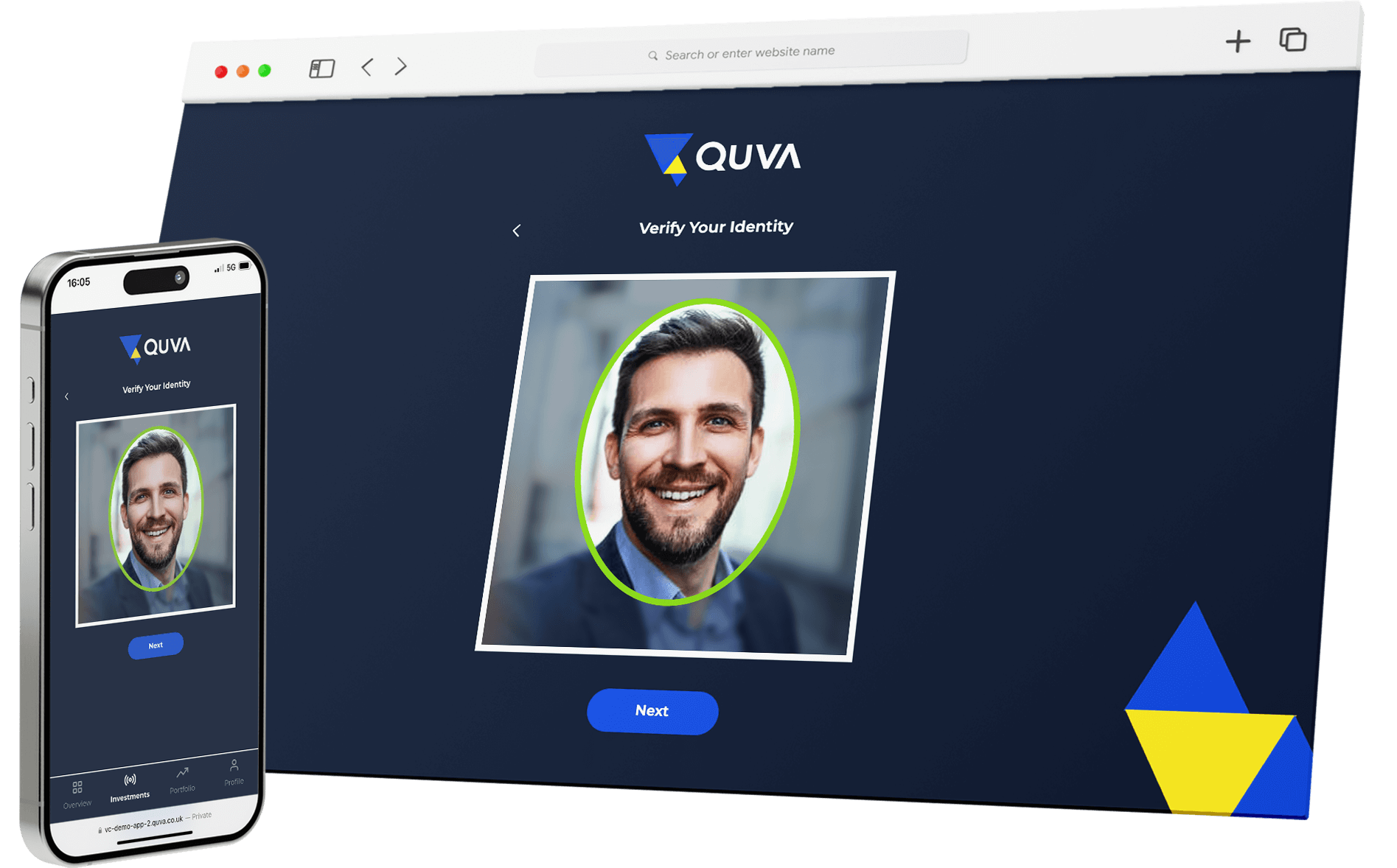

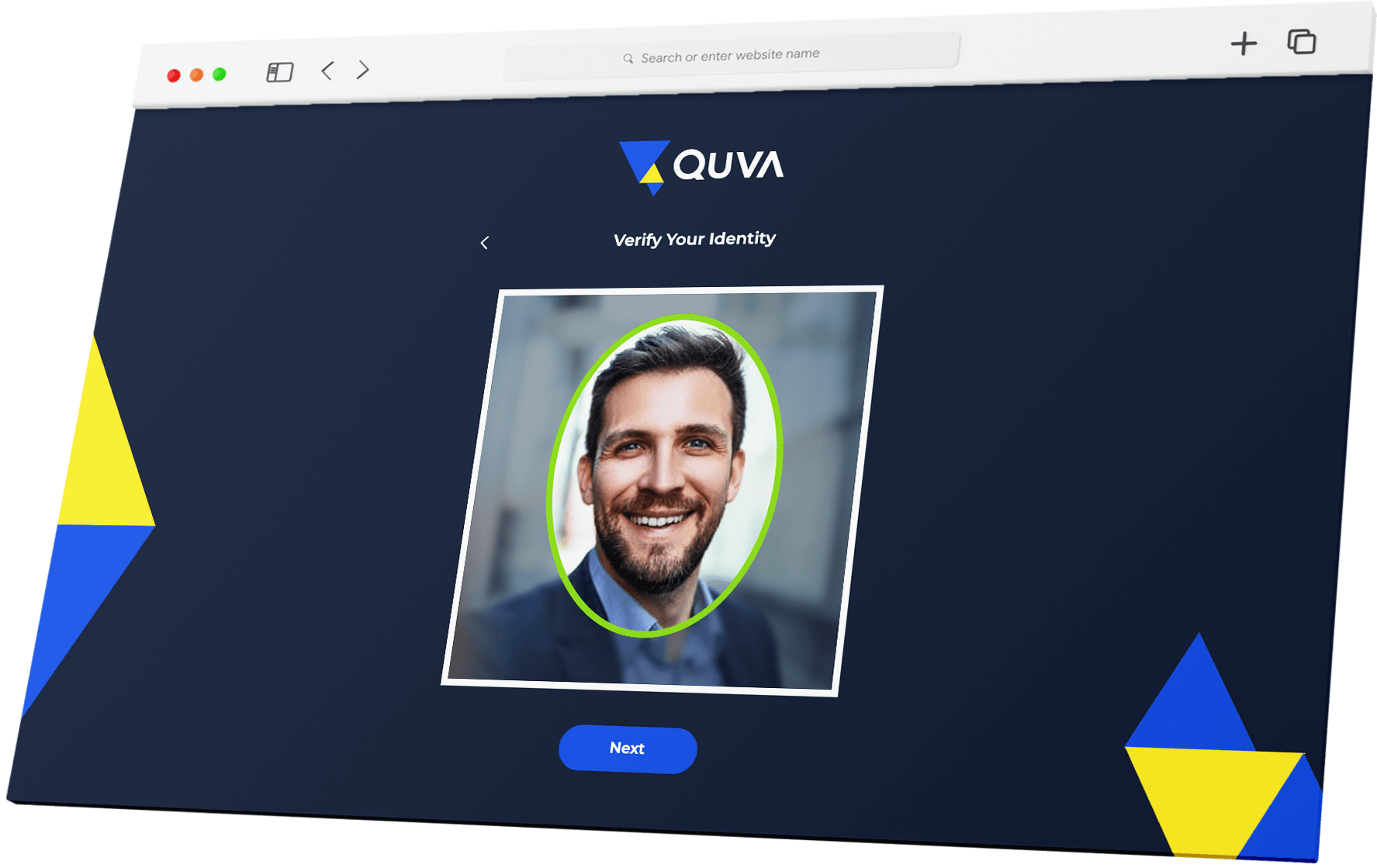

AML & KYC

Quva stands out in its capability to conduct thorough Anti-Money Laundering (AML) and Know Your Customer (KYC) checks, locally and internationally.

With continuous monitoring of Politically Exposed Persons (PEP) and sanctions lists, Quva ensures stringent compliance measures, safeguarding against financial risks and regulatory violations across diverse jurisdictions.

Documents

Quva's innovative platform offers automated document generation, including investor agreements, seamlessly pre-populated with essential details. This feature not only saves valuable time but also reduces paperwork and administrative burdens significantly.

Experience streamlined processes and increased efficiency with Quva's document capabilities.

Regulatory Incubation or Hosting Service

The team transforming alternative investments

We enable unregulated companies and individuals to begin and operate their regulated business quickly and efficiently using our FCA Authorisation.

Discuss your needs and see Quva in action with a live, in-depth and personalised demo.

Who we work with

Whether you’re looking to streamline how you manage your investments, or simply have a burning question, get in touch today and see how Quva can help take you and your business to the next-level.

Simply fill out the form and of our digital transformation experts will be in touch.