Solutions Made for Compliance Managers

Digitally transform your compliance processes with Quva's user-friendly and customisable platform

Compliance Made Easy

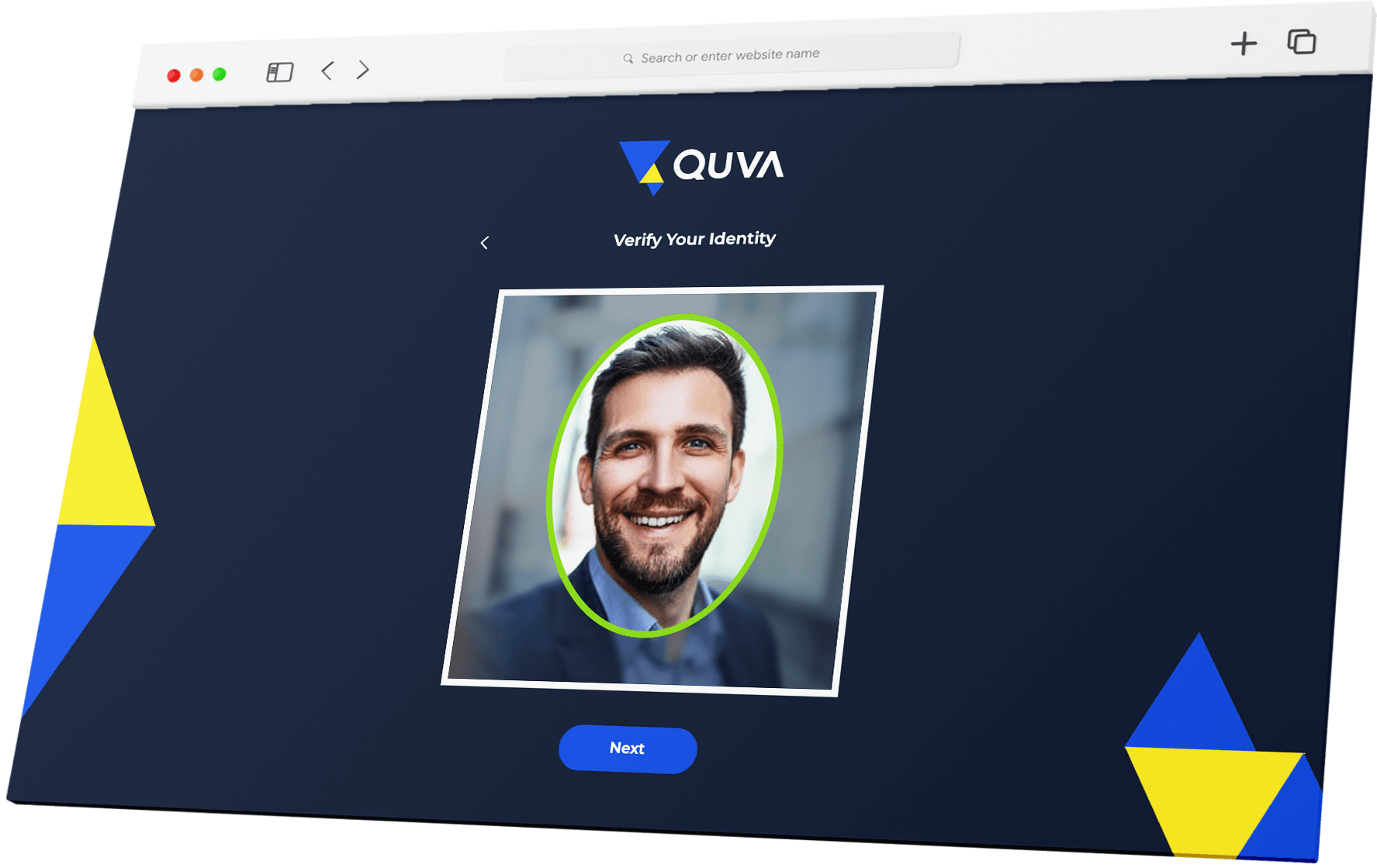

Quva's Compliance functionality ensures adherence to local and international regulations with customisable alignment. It conducts rigorous AML/KYC checks and monitors PEP and Sanctions lists in real-time. Administrators receive instant alerts regarding discrepancies, empowering organisations to manage regulatory complexities confidently, mitigate risks effectively, and maintain compliance seamlessly.

Control the Risk

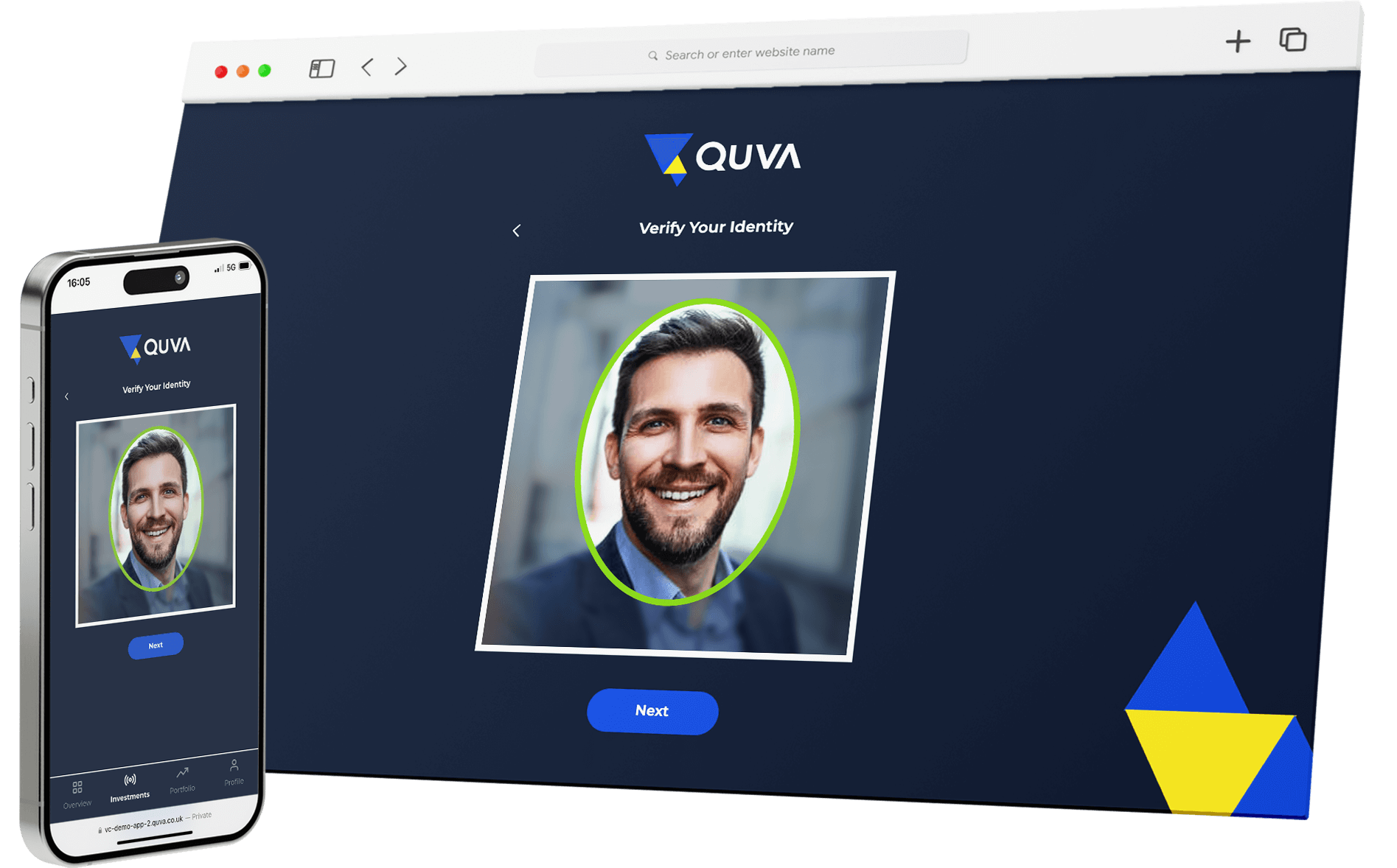

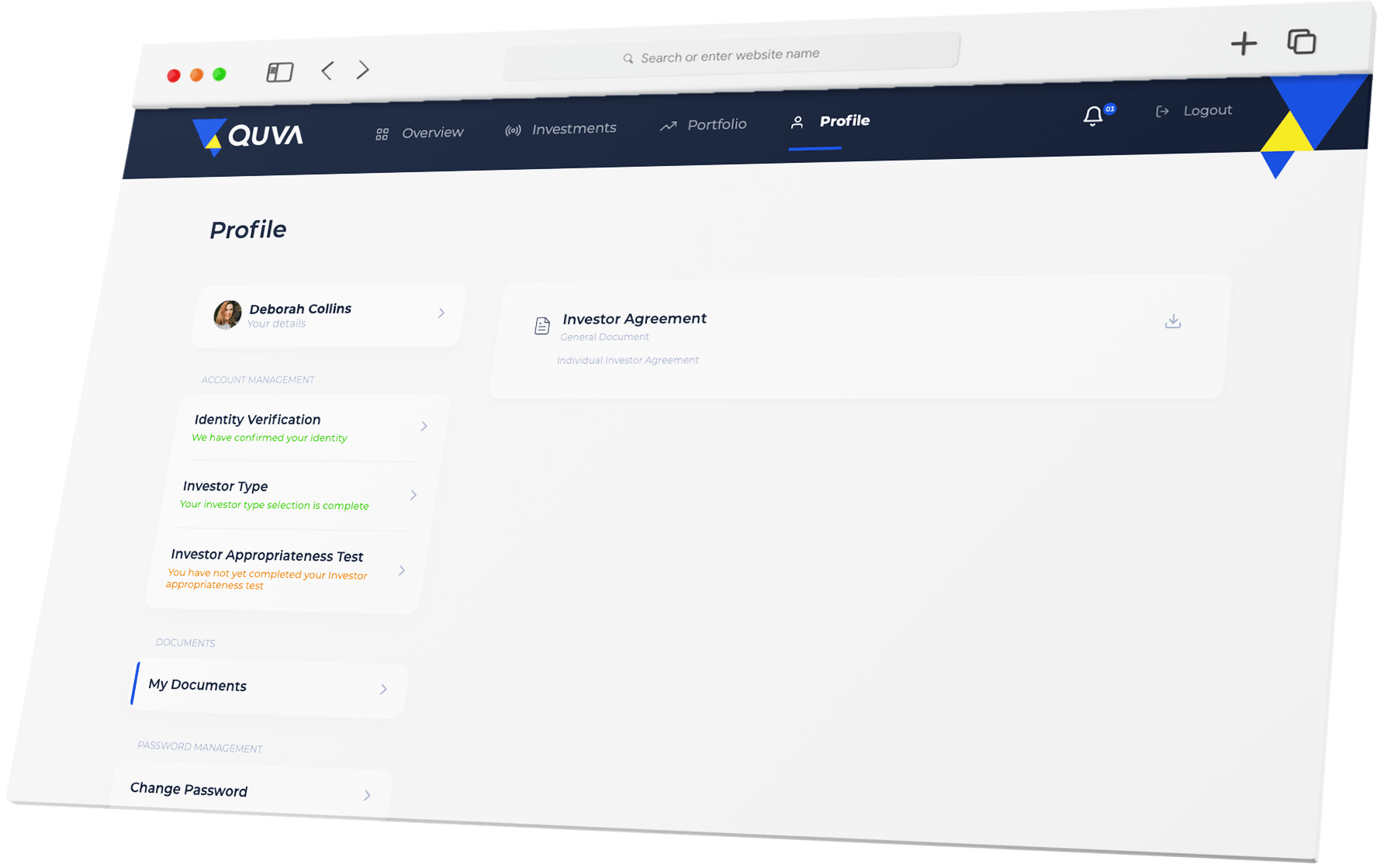

Quva's client portal allows investors to securely login to their client portal at anytime, anywhere. Quva's client portal increases engagement, efficiency and can help overall revenues by taking the administrative burden away. Just some of the features Quva's client portal has to offer:

- Create custom onboarding registration

- Run real-time AML & KYC checks

- Receive ongoing PEP and Sanction checks

- Content manage and create investor categorisation

- Create investor appropriateness tests

- Display regulatory messaging

- Enable NDA functionality

- Automatically generate compliance documents

- Communicate with investors throughout onboarding

Compliance Features

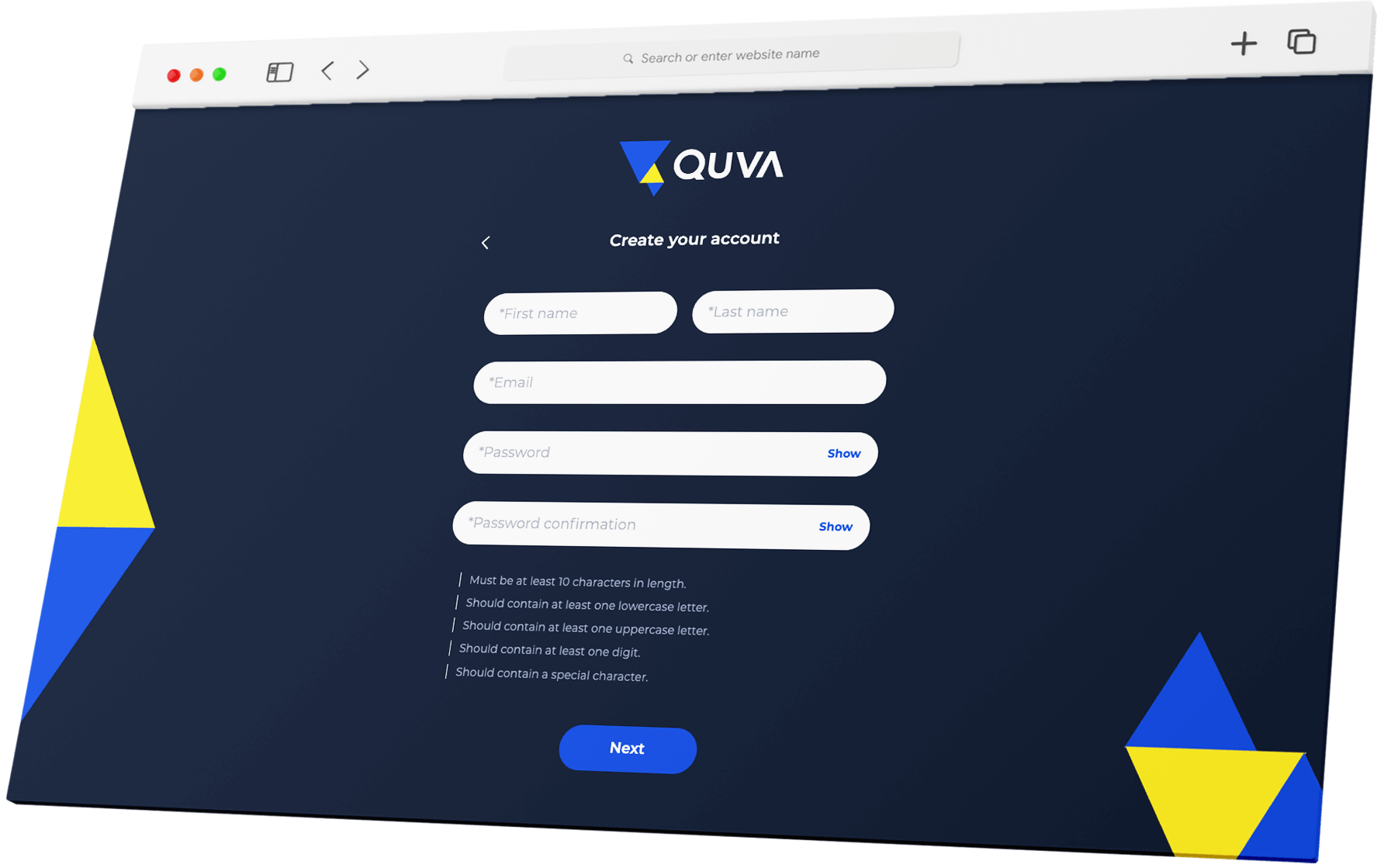

Bespoke Registration

Tailored precisely to individual requirements, Quva digitally transforms and streamlines client onboarding, Through innovative digital tools and personalised processes, Quva ensures a seamless transition, minimising administrative burden and enhancing client satisfaction.

Experience efficiency and precision like never before with Quva's bespoke onboarding registration.

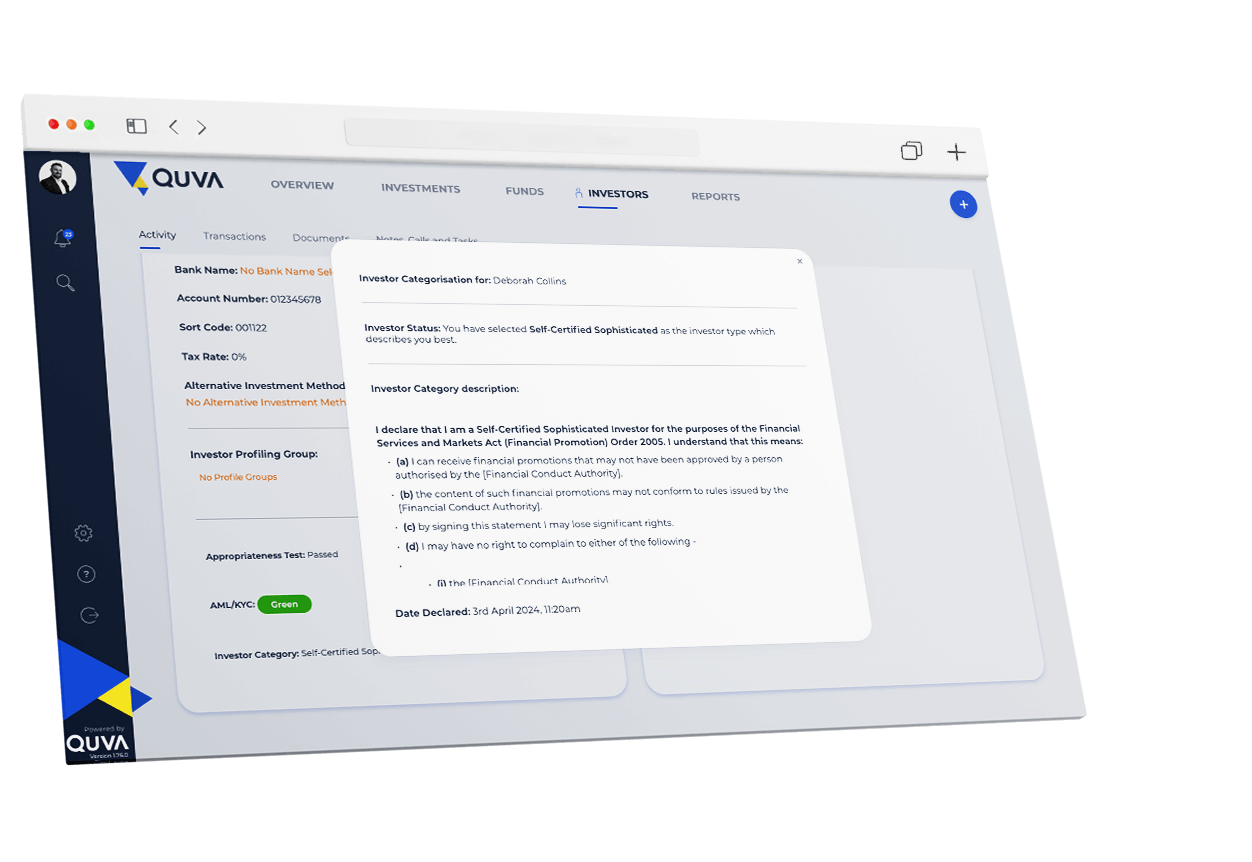

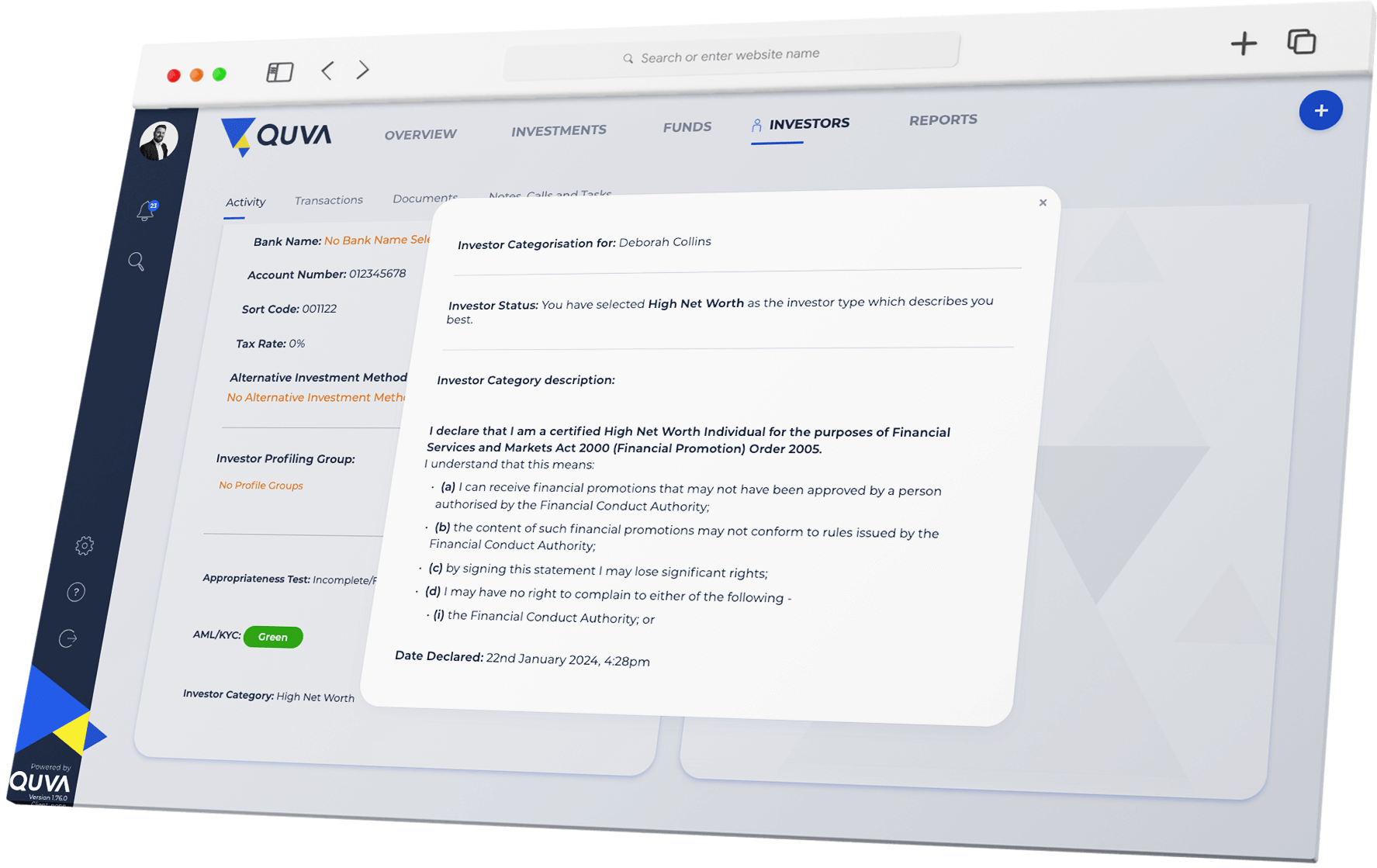

Investor Categorisation

Quva provides bespoke and meticulous investor categorisation, which is also documented to bolster compliance endeavours. By efficiently categorising investors based on your or regulatory criteria, Quva ensures adherence to compliance standards, mitigating risks and enhancing regulatory confidence.

Experience peace of mind knowing that Quva's robust categorisation process aligns seamlessly with your compliance requirements.

AML & KYC

Quva stands out in its capability to conduct thorough Anti-Money Laundering (AML) and Know Your Customer (KYC) checks, locally and internationally.

With continuous monitoring of Politically Exposed Persons (PEP) and sanctions lists, Quva ensures stringent compliance measures, safeguarding against financial risks and regulatory violations across diverse jurisdictions.

Documents

Quva's innovative platform offers automated document generation, including investor agreements, seamlessly pre-populated with essential details. This feature not only saves valuable time but also reduces paperwork and administrative burdens significantly.

Experience streamlined processes and increased efficiency with Quva's document capabilities.

Regulatory Incubation or Hosting Service

The team transforming alternative investments

We enable unregulated companies and individuals to begin and operate their regulated business quickly and efficiently using our FCA Authorisation.

Discuss your needs and see Quva in action with a live, in-depth and personalised demo.

Frequently Asked Questions

-

An appointed representative (AR) is a firm or person who runs regulated activities under the supervision of a directly authorised firm. This firm is known as the AR’s ‘principal’.

-

Appointed Representative Services offer a quick, easy and cost-effective alternative approach to receiving direct authorisation from the Financial Conduct Authority (FCA) to conduct financial services activities in the UK.Direct authorisation can take up to 12 months to complete and requires a significant amount of time and documentation. Through Appointed Representative Services and our Regulatory Umbrella Platform, we enable our clients to conduct regulated activities within only a few weeks, and as the Principal Firm, we assume the regulatory oversight of the Appointed Representative. This set-up is also referred to as an ‘Incubator’ or ‘Regulatory Hosting’.

-

Yes. Anyone performing a governing function for an appointed representative must be an approved person. Please see Chapter 10 of the FCA Supervision Manual in the FCA Handbook for a list of governing functions.

-

To become an appointed representative (AR) you need to:Decide which regulated activities you want to run and find a principal who conducts that type of business.Determine what contracts you need to have in place.Your principal(s) must inform the FCA of your appointment so the FCA can include this information on their register

-

The Quva Appointed Representative Service provides a number of benefits for alternative investment firms looking to conduct regulated financial services activities in the UK:Quick, efficient and cost-effective set-upSpeed to market – Conduct regulated activities within three to four weeksMonitoring plan, compliance policies, procedures and governance, all provided by Principal FirmConsiderably lower ongoing compliance costs compared to full authorisationCapital requirements provided by Principal FirmRegulated services are provided by Growth Capital Ventures Limited which is authorised and regulated by the Financial Conduct Authority of the United Kingdom. Quva provides software and non-regulated compliance services.

Who we work with

Whether you’re looking to streamline how you manage your investments, or simply have a burning question, get in touch today and see how Quva can help take you and your business to the next-level.

Simply fill out the form and of our digital transformation experts will be in touch.