Streamlining Compliance: 10 Reasons Why You Need to Digitise Your AML and KYC Process

In the fast-paced investment world, compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is paramount. These regulations are designed to prevent illegal activities such as money laundering, fraud and various other financial crimes, all whilst ensuring transparency and accountability in financial transactions.

Traditionally, AML and KYC processes have been paper-based, time-consuming, and prone to human errors. However, with the growth of digital technologies, there is a significant shift towards digitising these processes for the better.

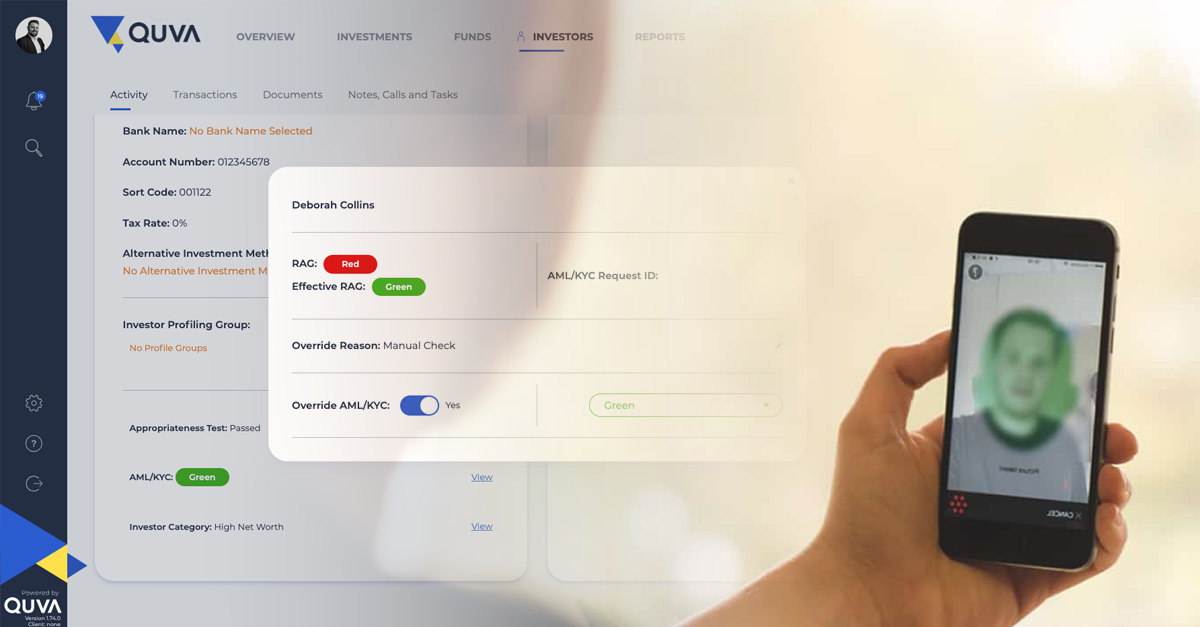

By leveraging technology like Quva, financial institutions and businesses can streamline their compliance efforts, improve efficiency, and enhance overall security.

Understanding AML and KYC

Before delving into the benefits of digitisation, it's essential to understand the core principles of AML and KYC, so what exactly are they?

AML (Anti-Money Laundering): AML refers to a set of regulations, laws, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income. Financial institutions are required to implement robust AML measures to detect and report suspicious activities.

KYC (Know Your Customer): KYC involves verifying the identity of clients/investors to ensure they are who they claim to be. This helps businesses assess potential risks associated with their customers/investors and enables them to monitor transactions effectively.

10 Reasons why you need to digitise your AML and KYC Processes

1. Efficiency: Digital processes streamline data collection, verification, and monitoring, reducing manual efforts and processing time. This efficiency allows for quicker onboarding of investors and can result in quicker transactions.

2. Accuracy: Automated data capture and validation minimise errors associated with manual entry, ensuring that information is accurate and up-to-date. This is crucial for regulatory compliance and risk management.

3. Enhanced Compliance: Digital AML and KYC solutions, like the one built into Quva, can integrate regulatory requirements and updates seamlessly, helping organisations stay compliant with evolving regulations and standards. Automated checks also ensure that investor due diligence processes adhere to compliance standards consistently.

4. Risk Mitigation: Digital tools enable real-time monitoring of customer transactions and behaviour, facilitating the timely identification of suspicious activities and potential risks. This proactive approach enhances risk management strategies and helps prevent financial crimes such as money laundering and fraud.

5. Cost Savings: By reducing manual labour, paper-based documentation, and the need for things like office space and physical storage, digitisation lowers operational costs associated with traditional AML and KYC processes. Organisations can allocate resources more efficiently and invest those savings toward other strategic parts of the business.

6. Improved Customer Experience: Digital AML and KYC processes offer a smoother onboarding experience for customers through user-friendly and bespoke interfaces, resulting in faster onboarding and less paperwork. Improved customer experience can also lead to higher satisfaction, engagement and loyalty with your investors.

7. Scalability: Digital solutions are easily scalable to accommodate increasing transaction volumes and business growth. They can also, and more importantly, adapt to changing legal requirements and support expansion into new markets or product offerings without significant infrastructure changes.

8. Insights and Analytics: Digital platforms provide access to vast amounts of customer data, which can be analysed to gain insights into customer behaviour, preferences, and risk profiles. Data like this can also enable organisations to make data-driven decisions and refine their AML and KYC strategies continuously.

9. Security: Digital platforms employ robust security measures to protect sensitive customer information and prevent unauthorised access or data breaches. Encryption, multi-factor authentication, and other security protocols safeguard data integrity and confidentiality.

10. Peace of Mind: In compliance with standard AML and KYC protocols, your investors undergo initial screening for Politically Exposed Persons (PEPs) and sanctioned individuals upon onboarding. Manual procedures necessitate recurrent checks, whereas digital solutions like Quva facilitate automated and continuous monitoring. This enables timely updates on investors' status changes, empowering swift action and ensuring optimal compliance - giving you ultimate peace of mind.

In summary, digitising your AML and KYC processes offers a wide range of benefits, including improved efficiency, accuracy, compliance, risk management, cost savings, customer experience, scalability, data analytics, security and peace of mind. These benefits help financial institutions and other investment organisations effectively manage regulatory requirements, mitigate risks, and foster trust with customers/investors - leading to loyalty and overall better engagement with your opportunities and portfolio.

To discuss how Quva can help you digitise your compliance and overall investment efforts, get in touch and speak to one of the team today.