Exploring the Pros and Cons of Building vs Buying an Investment Platform

In today's dynamic financial landscape, businesses and institutions face crucial decisions when it comes to managing their opportunities, portfolio and investor networks. One of the primary considerations is whether to build an in-house investment platform or opt to buy an off-the-shelf white-label investment platform. Both options come with their unique set of advantages and disadvantages, which must be carefully weighed before making a decision.

In this blog, we'll delve into the top x3 pros and cons of each approach to help you navigate this critical choice for your business.

Build

Let's dive in and take a closer look at the pros and cons of building an in-house investment platform, considering all the potential benefits and drawbacks it brings to the table.

Pros:

Concept to Creation: Perhaps one of the most significant advantages of an in-house investment platform is the level of initial input and control it offers. Organisations can tailor the platform precisely to their specific initial requirements, incorporating unique features, analytics tools, and proprietary algorithms - but keep in mind that this could take years to implement.

Security: With an in-house solution, companies can have good oversight and control over security protocols. They can implement robust security measures tailored to their existing needs and ensure adherence to industry standards without relying solely on external providers.

Intellectual Property: Developing an in-house investment platform allows organisations to retain ownership of their intellectual property. This can be a significant advantage in larger firms, where proprietary technology and algorithms provide a competitive edge at scale.

Cons:

High Development Costs: Building an in-house investment platform entails substantial upfront costs associated with development, infrastructure, and ongoing maintenance. The expenses may include hiring a team of skilled developers, investing in technology infrastructure, and dedicating resources to testing and optimisation, often into the hundreds of thousands of pounds with what could be deemed as a fluid time scale - usually resulting in further unexpected costs down the line. Not only does it cost money, the time you would have to invest into a project like this is also significant.

Time to Market: Developing an in-house investment platform requires time, expertise, and rigorous testing. As a result, organisations may face delays in bringing the platform to market, with some firms seeing delivery times of up to 2 years or more, potentially missing out on time-sensitive investment opportunities or lagging behind competitors who opt for off-the-shelf white-label solutions like Quva - who at the same time are constantly improving their offering.

Maintenance and Support: Maintaining and supporting an in-house platform can be resource-intensive. Organisations must allocate personnel and financial resources to address software updates, bug fixes, and user support, which may divert attention and resources from core business activities, not to mention the possibility of having to wait long periods of time for a resolution - resulting in downtime for both organisation and their investors.

Buy

Now let's delve into the pros and cons of buying an investment platform, considering the handful of drawbacks alongside the multitude of advantages it offers.

Pros:

Time and Cost Savings: Off-the-shelf white-label investment platforms like Quva offer a ready-made solution that can be deployed rapidly and at a fraction of the cost compared to developing an in-house platform. By leveraging existing software, organisations can avoid the expenses associated with development and infrastructure setup.

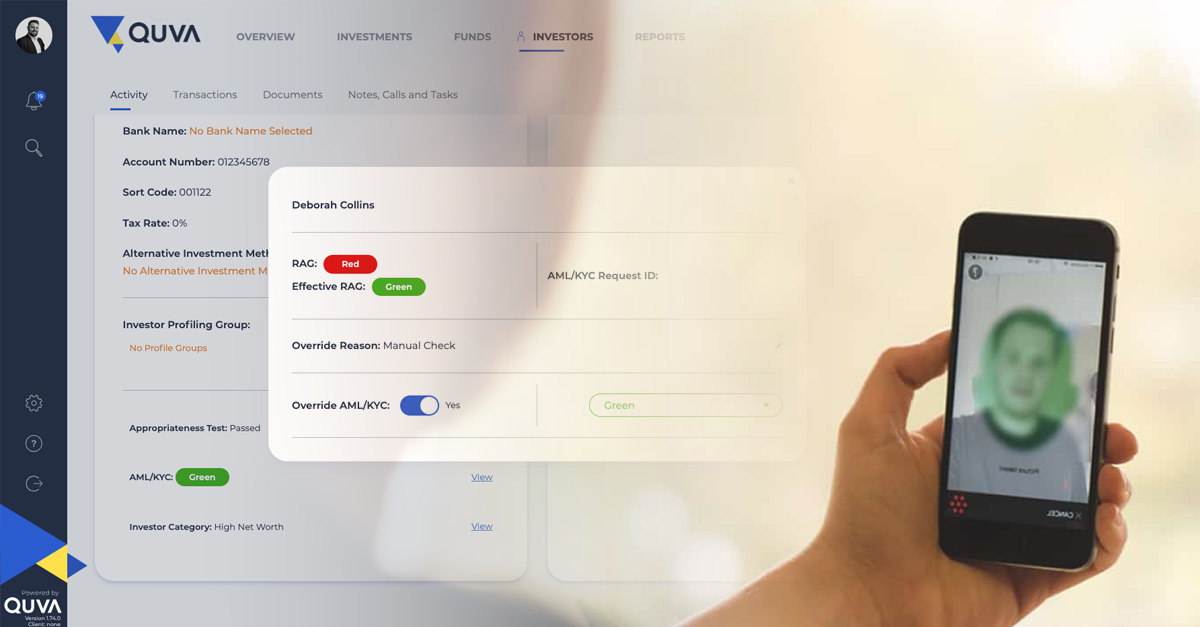

Configurability and Customisation: Contrary to common misconceptions, off-the-shelf solutions are not one-size-fits-all. In fact, white-label investment platforms like Quva offer a high degree of configurability and customisation options, allowing organisations to tailor the platform to their specific requirements. With a rich array of features, modules, and integration capabilities, off-the-shelf solutions empower users to adapt the platform to their unique investment strategies, terminology and workflows without the hassle and expense of building from scratch.

Vendor Expertise and Support: Choosing an established off-the-shelf solution grants access to the expertise and support of the vendor. Companies benefit from ongoing maintenance, software updates, and dedicated customer support, freeing up internal resources and mitigating the risks associated with managing complex investment platforms.

Cons:

Control: Relying on an external vendor means ceding a degree of control over the investment platform as a whole. This results in organisations trusting the vendor to prioritise data security, regulatory compliance, and uptime. However, this is often outweighed by the strict regulatory and industry requirements put in place for each vendor, meaning they have to adhere to the above at all times - resulting in the highest level of data security and compliance.

Vendor Lock-In: Adopting an off-the-shelf solution may lead to what’s often called vendor lock-in, where organisations become dependent on a specific technology vendor and infrastructure. Switching to a different platform could be complex and disruptive, especially if the organisation has integrated its workflows and processes tightly with the vendor's solution. However, firms like Quva have an experienced team who can seamlessly transition existing data and processes into a new and bespoke platform with ease.

Dependency on Vendor Roadmaps: Off-the-shelf investment platforms are subject to the development roadmaps and priorities of the platform vendor or provider. Businesses relying on these platforms may feel like they have limited influence over the direction of product development, feature enhancements, or bug fixes. However, Quva’s product roadmap is built on industry trends, regulatory compliance changes and most importantly, the feedback from our clients, prospects and partners.

In conclusion, when considering whether to build an in-house investment platform or choose an off-the-shelf white-label solution, several factors come into play, such as budget constraints, strategic goals, and risk tolerance. While in-house platforms can offer levels of customisation and control, they demand significant investments in time, resources, and expertise from the off. Conversely, off-the-shelf solutions deliver convenience, cost savings, and vendor support, making them the preferred choice for alternative investment professionals.

Ultimately, organisations must thoroughly assess their priorities and carefully weigh the advantages and disadvantages of each option. However, it's clear that off-the-shelf solutions emerge as the superior choice, offering unmatched benefits that align with long-term investment goals and operational needs.

To discuss your investment platform needs in more detail, more so learn how Quva can benefit you, get in touch with one of the team and get a personalised demo of the Quva platform today.