Syndicated Residential Property Investment UK - Technology Driving Opportunity

Discover how technological advancements are revolutionising the property investment landscape in the UK.

The Rise of PropTech in Property Investment

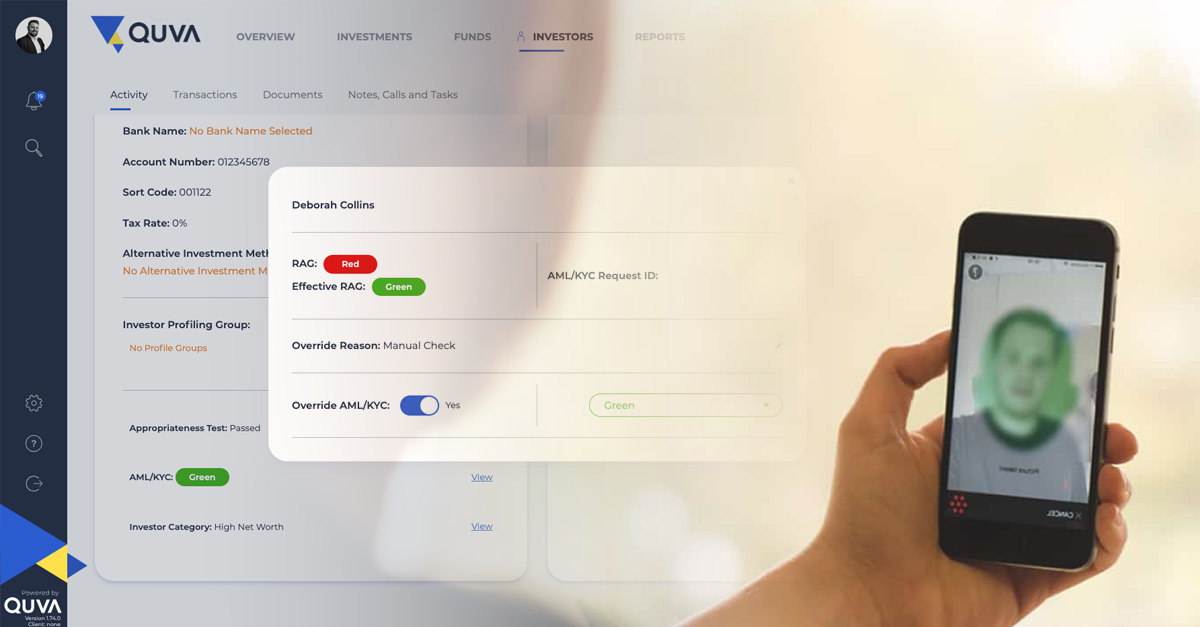

The property investment industry is undergoing a significant transformation with the rise of technology. PropTech, which stands for Property Technology, refers to the use of innovative digital solutions that are revolutionising the way property investment firms operate. These technological advancements have opened up new opportunities for property investment companies, allowing them to streamline their processes, improve efficiency, and provide better services to their clients.

One of the key benefits of PropTech in property investment is the ability to gather and analyse vast amounts of data. With the help of advanced analytics tools, property investment firms can now make data-driven decisions, identify investment opportunities, and assess property values more accurately. This has led to increased transparency and reduced risks for both investors and developers.

Furthermore, technology has also enhanced the marketing and communication strategies of property investment firms. Through various real estate software solutions and white label investment platforms, these companies can now reach a wider audience of potential investors. They can showcase their investment products, provide virtual tours of properties, and engage with clients in real-time. This has made the process of investing in residential properties more accessible and convenient for individuals looking to enter the market.

Overall, the rise of PropTech in property investment is transforming the industry by leveraging technology to drive growth, efficiency, and innovation. It is enabling property investment firms to adapt to the changing landscape and cater to the evolving needs of their clients.

Syndicated Investments: A Modern Approach

Syndicated investments have emerged as a modern approach to property investment in the UK. This investment strategy involves pooling together funds from multiple investors to acquire residential properties. It offers several advantages for both investors and developers.

For investors, syndicated investments provide an opportunity to diversify their portfolios without the need for substantial capital. By pooling their resources with other investors, they can access larger and potentially more lucrative property investment opportunities. This allows them to spread their risks and maximise their returns.

On the other hand, syndicated investments also benefit property developers and investment companies. They can raise capital more efficiently by attracting a larger pool of investors. This enables them to undertake larger development projects and achieve economies of scale. Additionally, syndicated investments promote collaboration and knowledge-sharing among investors, which can lead to better decision-making and successful outcomes.

With the integration of technology, syndicated investments have become even more accessible and efficient. Online platforms and investment portals have simplified the process of finding and joining syndicates. Investors can now browse through a wide range of investment opportunities, evaluate the potential risks and returns, and make informed investment decisions.

In conclusion, syndicated investments offer a modern approach to property investment, allowing investors to diversify their portfolios and developers to access larger capital. The integration of technology has further enhanced the accessibility and efficiency of syndicated investments, making it a compelling option for both seasoned and novice investors.

Benefits of Technology Integration in Property Investment

The integration of technology in property investment brings numerous benefits for both property investment companies and their clients.

One of the key benefits is enhanced efficiency. Technology enables property investment firms to automate various processes, such as property valuation, risk assessment, and documentation. This not only saves time but also reduces manual errors and improves accuracy. It allows property investment companies to handle a larger volume of transactions and provide faster services to their clients.

Moreover, technology integration provides access to a wealth of data and analytics. Property investment firms can leverage advanced analytics tools to analyse market trends, property performance, and investment opportunities. This data-driven approach helps in making informed investment decisions and maximising returns for investors.

Another significant benefit is improved transparency. Technology allows property investment firms to provide real-time updates and reports to their clients. Investors can track the progress of their investments, monitor property performance, and receive regular updates on income and expenses. This transparency builds trust and confidence among investors, ensuring a positive client experience.

Additionally, technology integration enables better communication and collaboration between property investment firms and their clients. Online platforms and portals facilitate seamless communication, allowing investors to interact with property managers, ask questions, and receive prompt responses. This fosters a strong client relationship and enhances customer satisfaction.

In summary, technology integration in property investment offers enhanced efficiency, access to data-driven insights, improved transparency, and better communication. These benefits contribute to a more streamlined and client-focused property investment experience.

Challenges and Solutions in Implementing Technology

While technology brings numerous benefits to property investment firms, its implementation also comes with challenges that need to be addressed.

One of the main challenges is the initial investment and ongoing costs associated with technology implementation. Property investment firms need to allocate resources for acquiring and implementing the necessary technology infrastructure. They also need to consider the maintenance and upgrade costs to ensure the technology remains up-to-date and efficient.

Another challenge is the resistance to change. Technology implementation often requires a change in processes and workflows, which can be met with resistance from employees. It is important for property investment firms to provide adequate training and support to help employees adapt to the new technology and understand its benefits.

Data security and privacy concerns are also significant challenges. Property investment firms deal with sensitive client information, and it is crucial to ensure the security and privacy of this data. Robust cybersecurity measures need to be implemented to protect against data breaches and unauthorised access.

To overcome these challenges, property investment firms can adopt a phased approach to technology implementation. They can start with smaller pilot projects to test the effectiveness and feasibility of the technology. This allows them to identify any potential issues or challenges and make necessary adjustments before implementing the technology on a larger scale.

Furthermore, collaboration with digital transformation partners and experts can provide valuable insights and guidance. Property investment firms can leverage the expertise of technology professionals to identify the most suitable solutions for their specific needs and ensure a smooth implementation process.

In conclusion, while implementing technology in property investment comes with challenges, proper planning, investment, and collaboration can help overcome these obstacles and reap the benefits of technology-driven solutions.

Future Trends in Technology-Driven Property Investment

The future of property investment is expected to be heavily influenced by technology-driven advancements. Several trends are likely to shape the industry in the coming years.

One of the key trends is the increasing use of artificial intelligence (AI) and machine learning. AI-powered algorithms can analyse vast amounts of data to identify investment opportunities, predict market trends, and optimise property management. This enables property investment firms to make more accurate investment decisions and maximise returns for their clients.

Another trend is the rise of virtual reality (VR) and augmented reality (AR) technologies. These immersive technologies allow investors to experience properties virtually, even before they are built. VR and AR can provide virtual tours, interactive floor plans, and realistic visualisations, enhancing the decision-making process for investors and improving the marketing strategies of property investment firms.

Furthermore, blockchain technology is expected to revolutionise property investment by providing transparent and secure transaction processes. Blockchain can facilitate fractional ownership, streamline property transactions, and enable efficient property management. It has the potential to eliminate intermediaries, reduce costs, and enhance trust and transparency in the industry.

Lastly, the Internet of Things (IoT) is likely to play a significant role in property investment. IoT devices can gather real-time data on property performance, energy consumption, and security. This data can be used to optimise property management, enhance sustainability, and improve the overall investment portfolio.

In conclusion, the future of technology-driven property investment is bright and promising. AI, VR, AR, blockchain, IoT, property focused software solutions and white label investment platforms are expected to transform the industry, providing innovative solutions and opening up new opportunities for property investment firms and their clients.