Client Onboarding

Manage the entire client onboarding process from the investor categorisation process through to Anti Money Laundering (AML) and Know Your Customer (KYC) verifications.

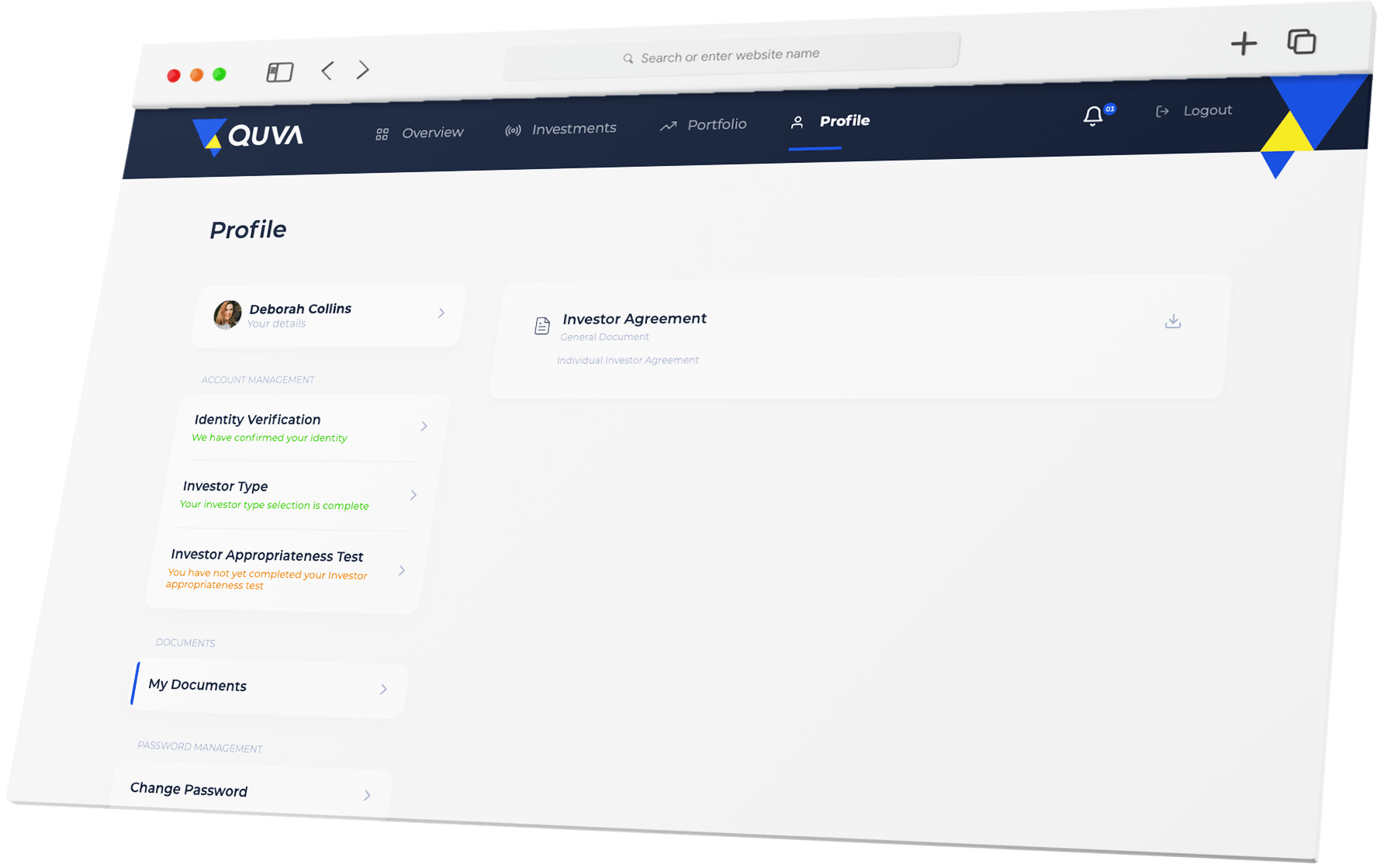

Client Onboarding Module

Effortlessly enhance your client onboarding process with Quva. Benefit from highly configurable and customisable features, enabling you to oversee every stage from investor categorisation to thorough Anti Money Laundering (AML) and Know Your Customer (KYC) verifications, ensuring robust regulatory compliance and delivering a seamlessly smooth experience for both you and your clients.

Transform Your Onboarding

By embracing digital transformation in your onboarding process, you not only alleviate administrative burdens but also unlock a host of benefits, including:

- Bespoke registration process tailored to your exact requirements

- Documented and recorded Investor Categorisation

- AML and KYC checks done as standard

- Ongoing PEP and Sanction checks with real-time alerts

- Documents automatically generated and pre-populated with key information

- e-Signature and consent functionality

- Ability to approve or reject applicants

Client Onboarding Features

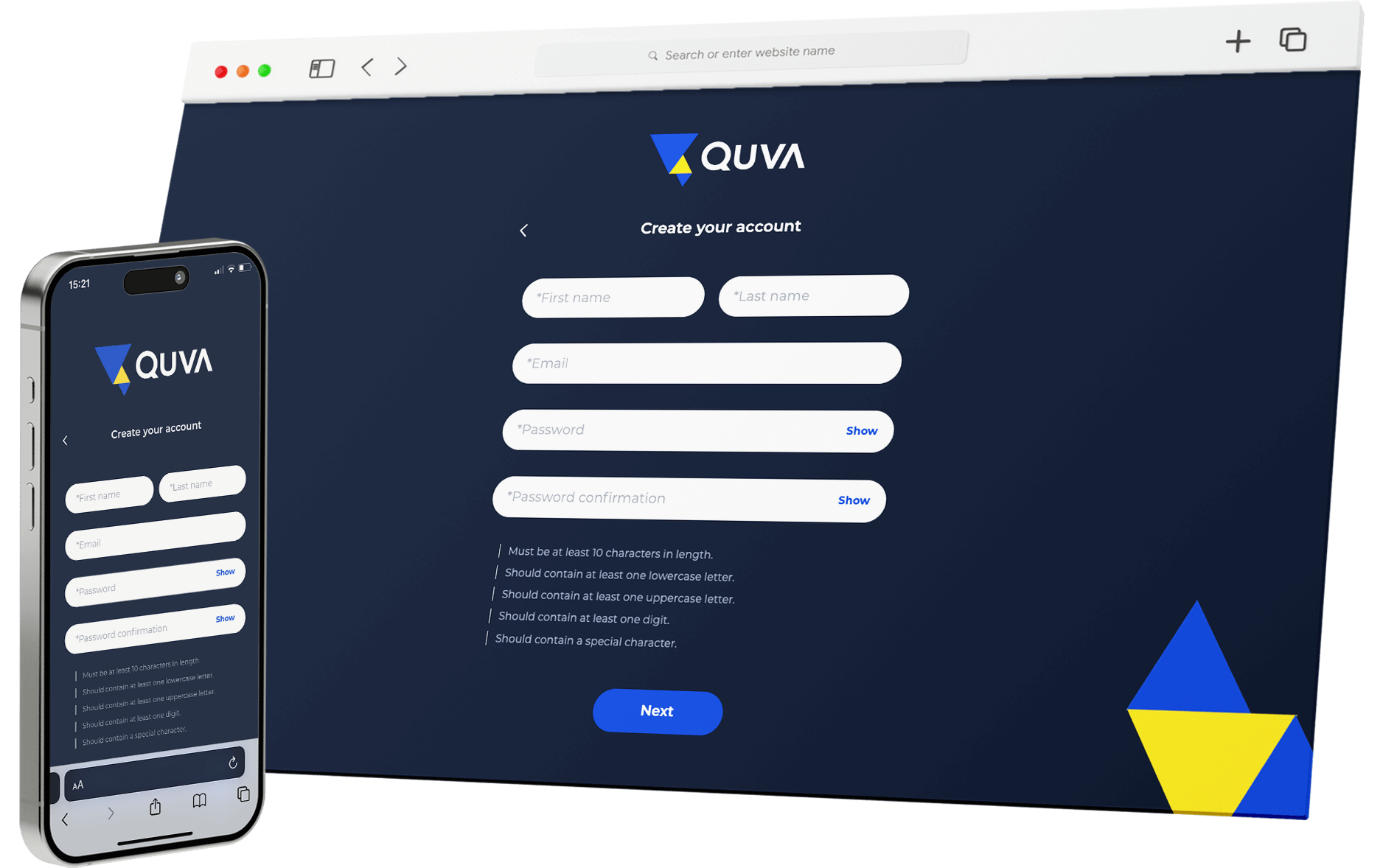

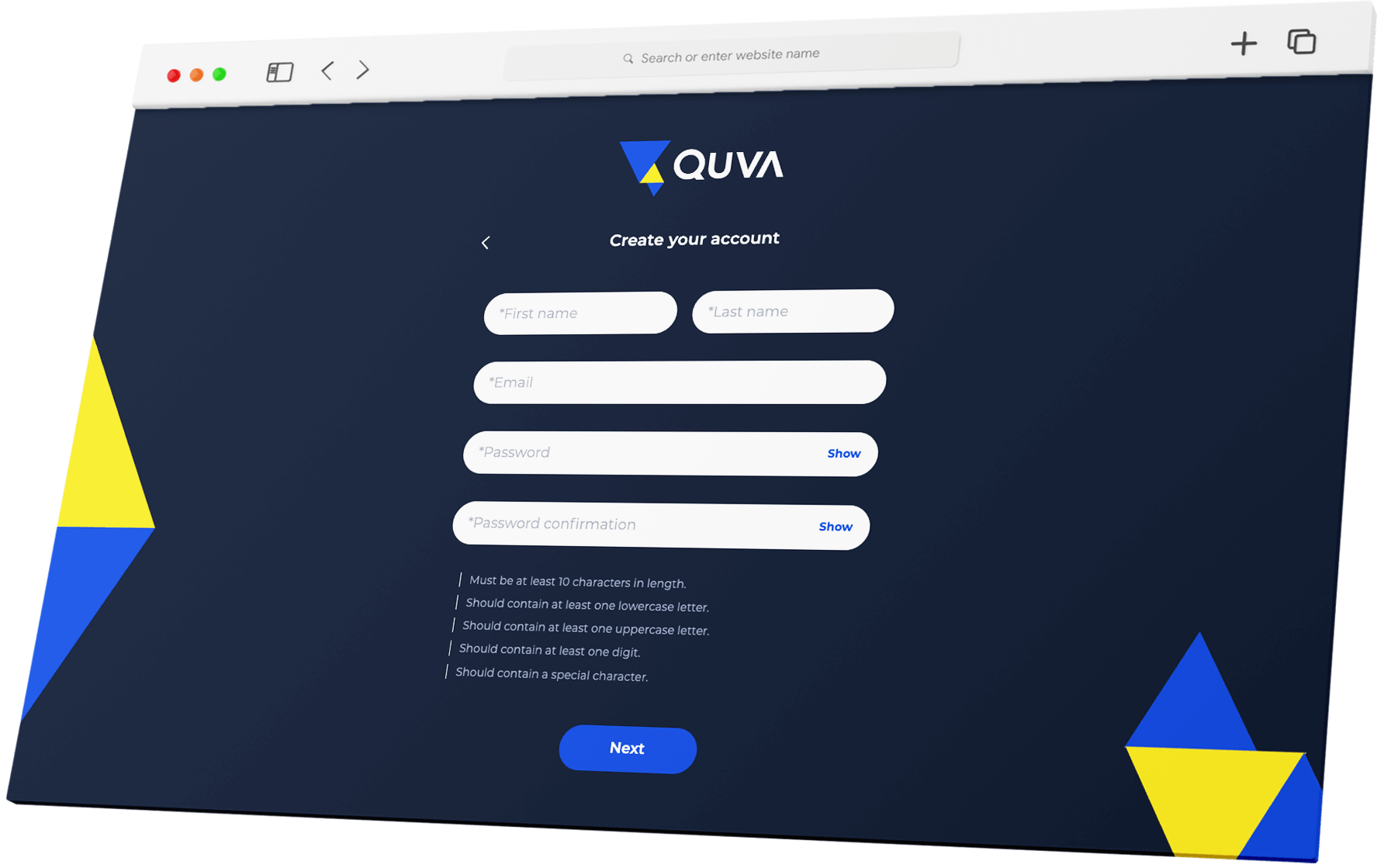

Bespoke Registration

Tailored precisely to individual requirements, Quva digitally transforms and streamlines client onboarding, Through innovative digital tools and personalised processes, Quva ensures a seamless transition, minimising administrative burden and enhancing client satisfaction.

Experience efficiency and precision like never before with Quva's bespoke onboarding registration.

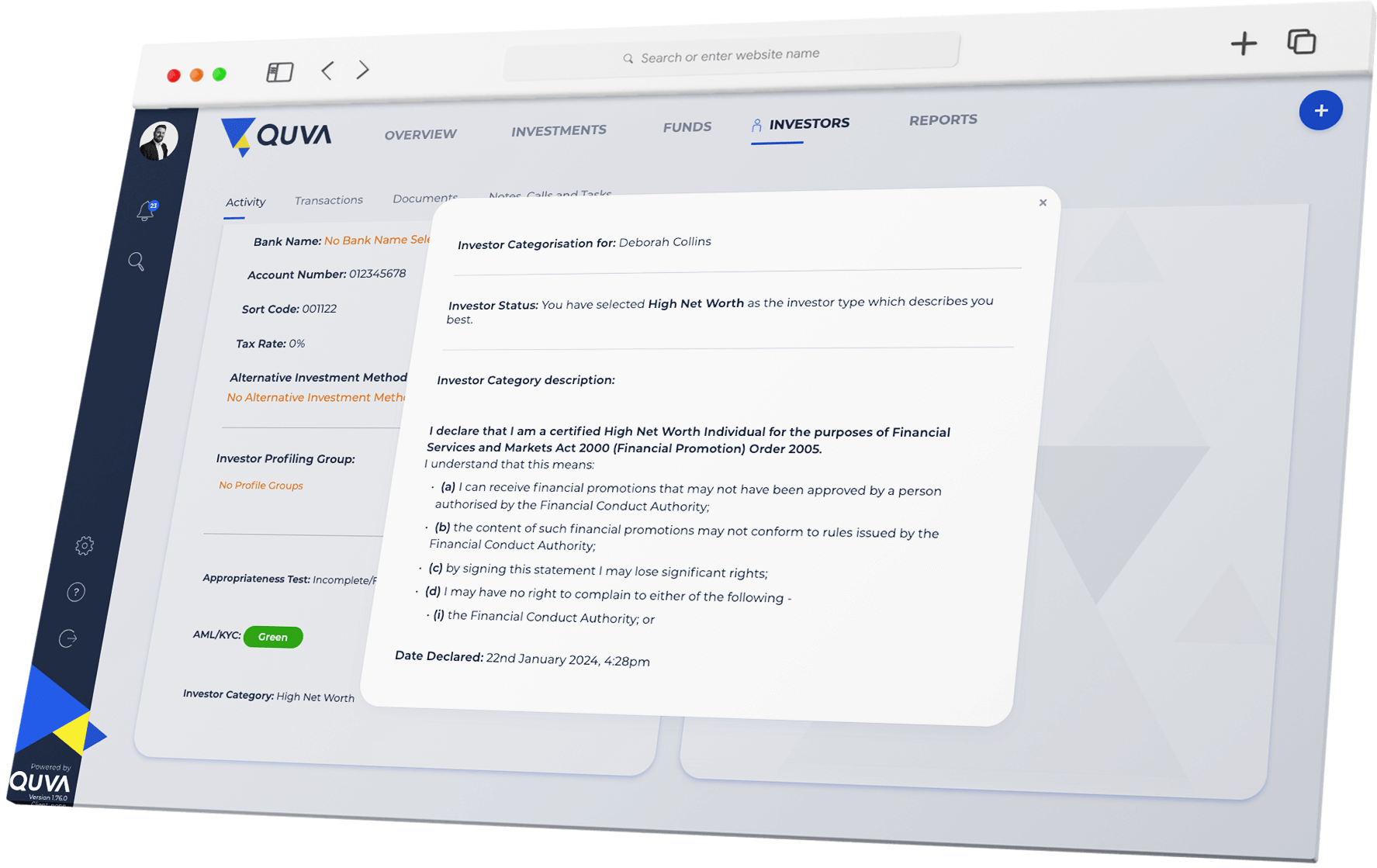

Investor Categorisation

Quva provides bespoke and meticulous investor categorisation, which is also documented to bolster compliance endeavours. By efficiently categorising investors based on your or regulatory criteria, Quva ensures adherence to compliance standards, mitigating risks and enhancing regulatory confidence.

Experience peace of mind knowing that Quva's robust categorisation process aligns seamlessly with your compliance requirements.

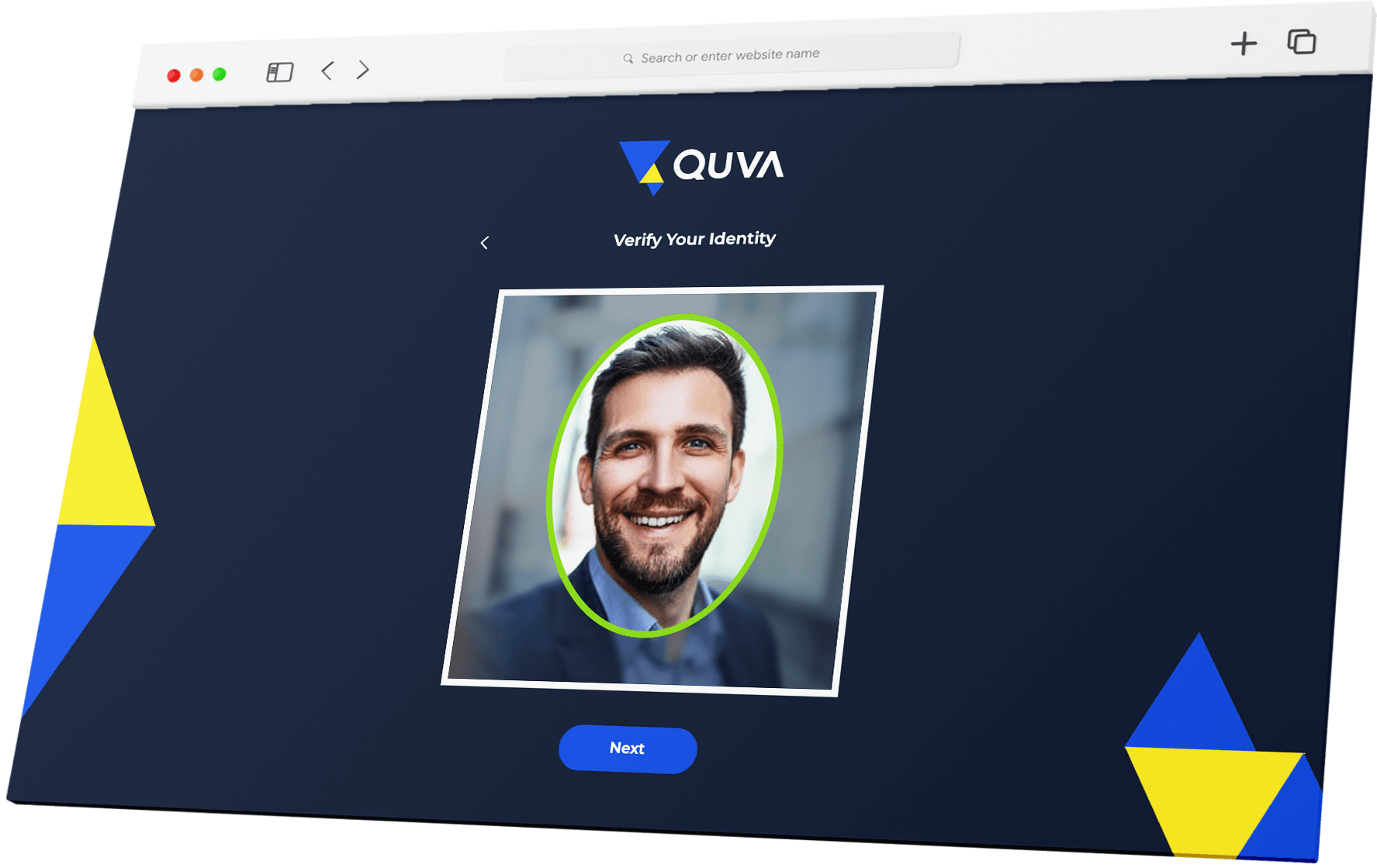

AML & KYC

Quva stands out in its capability to conduct thorough Anti-Money Laundering (AML) and Know Your Customer (KYC) checks, locally and internationally.

With continuous monitoring of Politically Exposed Persons (PEP) and sanctions lists, Quva ensures stringent compliance measures, safeguarding against financial risks and regulatory violations across diverse jurisdictions.

Documents

Quva's innovative platform offers automated document generation, including investor agreements, seamlessly pre-populated with essential details. This feature not only saves valuable time but also reduces paperwork and administrative burdens significantly.

Experience streamlined processes and increased efficiency with Quva's document capabilities.

Made by Investment Professionals for Investment Professionals

The team transforming alternative investments

What Our Clients Say About Us

“The software development team at Quva have provided Maven with a bespoke Investment Platform that has streamlined the management of our Private Investor Network.

The Quva team worked closely with our project team to scope, develop and launch a custom-made software solution that has transformed the investment management, transaction and distribution process."

"We've had an exceptional experience partnering with Quva. Their collaborative approach and deep understanding of the early-stage space and investor requirements in our niche have been invaluable.

Quva adapted their platform seamlessly to align with our specific needs, resulting in a user-friendly, intuitively designed system that has garnered praise from our investors.

What truly sets Quva apart is their incredibly responsive customer success team, who have been instrumental in ensuring that the system not only meets but exceeds our workflow expectations. Quva's dedication to customer satisfaction is a real differentiator and has made them an indispensable partner for us."

Since the integration of Quva, our entire operational landscape has undergone a digital transformation.

From the automation of documents to a streamlined registration process incorporating the highest standards of AML/KYC compliance, our platform now stands as a secure and intelligent space for our investors, who can now seamlessly access exclusive opportunities and track performance.

Quva not only met our bespoke requirements but continues to collaborate closely with us, ensuring ongoing compliance, operational efficiency and operational resilience.

We wholeheartedly recommend Quva for their commitment to delivering and maintaining a top-level platform for both our business and our valued investor network."

“When Regional Housebuilder Homes by Carlton wanted to explore innovative ways to finance its growing residential development programme we turned to Quva to explore options.

We wanted to develop and launch an online investment platform that would allow experienced investors to invest and provide development loans to Homes by Carlton.

Our Project Team worked closely with the Quva Team to create and launch Carlton Bonds, an online investment platform that allows experienced investors to invest in a series of asset-backed bonds.

The platform provides Homes by Carlton with an innovative way to fund our growing pipeline of residential development projects."

The platform is fantastic and now an integral and paramount part of the business.”

Moreover, Quva's platform provides a secure and seamless experience for our investors, ensuring their trust and satisfaction.

Thanks to Quva, we've elevated our efficiency while enhancing investor accessibility - a partnership we value immensely."

Who we work with

Whether you’re looking to streamline how you manage your investments, or simply have a burning question, get in touch today and see how Quva can help take you and your business to the next-level.

Simply fill out the form and of our digital transformation experts will be in touch.